Friday, February 21, 2014

Eur Aud bearish outlook

After a strong bearish move from 1.5770 which started on 24th January of this year, breaking 1.5300 with high momentum and finally reversed with a bullish engulfing caldlestick formation at 1.5020.

The reversal started on 12th of February back to retesting 1.5300 ( a support terned resistance ) with a pin bar bearish reversal candlestick formation.

I expect a reversal from here with retracement to 1.5280 before the bearish movement starts.

The target should be close to 1.5020 which should welcome price before it determines its next move. The stop loss will be about 5-10 pips above the pin bar.

This scenerio will become invalide if price broke the pin bar today or tomorrow with a high momentum to break 1.5300 upside to face 1.5550 and finally 1.5770, but this will take some time

Trade with caution and maintain proper management

Thursday, February 13, 2014

AudUsd and Audchf bearish signal

Due to my analysis yesterday about these two pairs

I will be going for a sell at a little reversal

Please check my previous posts about these pairs

GET HECTOR DEVILLE FOREX COURSE IN NIGERIA

I have been a forex trader for a while. There were times when I solely depend on indicators, you need to see how heavy my chart was. I was confused day-by-day and I changed from one strategy to the other. No concistent result, instead I wasted a few accounts. I was frustrated and took a time from forex. I thought it wasn't real and those claiming to be successful were scammers.

I started learning price action trading systems and I began to see the mind of great traders, why they trade what they trade. I began to recognise levels to watch out for. I learnt how the market react to these levels

It was then I realised forex market is a very organised market. You need to be well harmed to be successfulI proceeded to learning how and where to place stop loss and target profits; how to exit a loosing trade; profit and loss management; risk/reward ratio and how to accumulate profits.

If you are reading this, and you have been in my shoes or are in it presently, you will understand how frustrating forex can be

I had a breakthrough when I subscibed to a course online anchored by a man called Hector Deville.Hector is not only a profitable full-time trader but a good trainer too. This course contained a lot of videos and discussed about 5 different powerful and highly profitable simple systems.

I learnt why market react the way they do, what to expect from the market, how to snipe it and come out profitably more times with a risk reward ratio of 1:2 at least. I learnt how to keep a trading journal, how to manage risk, how to manage my profits and how to manage my losses ( many don't understand this).

I studied this course very well and I chose one strategy out of this five, modified it to suit me, and that is the basis of my analysis on this blog.I have traded actively with this strategy and make an average of 850pips on a monthly basis trading 1-2 hours daily. I have a job I keep, I trade forex part-time and I still trade very profitably.

Perhaps, when I decide to trade full time, I will incorporate other strategies discussed in the course

For people who want to learn profitable forex systems that experts and profitable traders use, here we go....Let me take you through Hector Deville course.

First, Hector explains the theory behind all his strategies: how they work, why they work, what principles they are based on, what to do in order to trade them and how to do it. It is important that you understand the reasoning behind a system so you can take your trading decisions with the full awareness of what's going on behind the curtains, he walks you through the method step by step, so you can follow him all the way along the video presentation.

Then he shows you a video where he applied that same trading strategy in a live trade recorded in real time! You will see absolutely everything: entry levels, stop loss, exit levels, potential risks of the trade, partial exit levels, etc. As the trade unfolds in real time, he explains how he manages the trade and the logics behind taking this or that trading decision. Literally, it's as if you were watching him trade live over his shoulders as he "comments" on the trade all the way through!

Let’s face it!Whether you are new to forex or you’ve been trading forex before, you need to sustain consistent profitability.

The 3 SMA Trend-Riding StrategyThis strategy is essentially what was taught in Hector’s original Hector Trader course. It uses 3 simple moving averages to define dynamic areas of support and resistance, which when combined with a good trend gives you extremely accurate entries in the direction of the trend. This strategy is easy to learn, and it works on virtually all timeframes and currencies.

The London Open Breakout SystemIn this module Hector teaches a price action based breakout strategy, not the typical mechanical set of rules that most people use to trade the London open. I have not personally tested this strategy (because the London open is at an inconvenient time for me due to my nature of job), but I went through the modules and it definitely seems very profitable. Good for full time traders who can watch early london opensHere is what you get in this system

20 videos (6:30 hours total)(Daily box indicator, average true range and round number indicators)• Intraday trading system.• Early morning trades (2 hours a day).• Applicable to EUR and GBP crosses.• 50 to 100 pips per trade.

The Market Flow Strategy In this module Hector teaches a number of strategies that are based on price action and support & resistance and like the 3SMA system it works on most timeframes and currency pairs and it generates trading opportunities with very good risk/reward ratiosMARKET FLOW MODULE contains 20 videos (5 hours total) (magic bar indicator, average true range and Daily Box indicator)• Intraday trading system.• Trades all around the clock.• Applicable to any currency pair.• Aims for small, quick trades.

The Part-Time TraderThe part time trader is without a doubt my most favourite strategy in the course. In this module Hector teaches how to trade well known price action strategies like pin bars and inside bars at key levels on the daily charts with exact entry and exit strategies and many live trade examples. There are many fulltime traders who use this exact strategy, so I highly recommend that you don’t skip this one.

The News trading SystemIn this module Hector teaches a unique technique for trading news releases with price action. I haven’t really tried this strategy yet, but it’s definitely an interesting system that seems to be quite profitable.NEWS TRADING MODULE-13 videos (4 hours total)• High-momentum trading.• Blend technicals and fundamentals.• Exploit the news extra volatility,Ultra-fast trades MONEY MANAGEMENT SCIENCE MODULE 13 videos (5 hours total)• Correlation indicator.• Money Management indicator.• Sequential Exits indicator.• Shows you how to systematically protect your trading capital from being wiped out.

ADVANCE FOREX INDICATORS MODULE• Trend Scanner Indicator (shows currency pairs that are trending in real time.)• Forex Currency Index Indicator (shows currencies gaining or loosing strength across the board and how strongly so.)• Tutorial video on how to install them.• Tutorial video on how to trade with them.• These Indicators alone can be used to make a steady income stream over time. In addition, a set of advanced indicators that are unlike anything I’ve ever seen before. You can definitely trade without any of these custom indicators, but the forex currency index and trend scanner indicators can be really helpful when you are looking for extra confirmations before entering trades.The benefit you will derive from this trading course is a sound understanding of how the market works. You will have all you need to make sound trading decisions that will ensure that you are trading successfully for years to come.All Indicators Are Real Time Indicators: They are not lagging indicators

The training program is valued at $497 which is about N80, 000 or more please, (CHECK: http://www.learnforexlive.com/store.php) but i am giving it away for just 8,000 naira only for a very limited time.

Send a message of interest to 08134820569 or call between 7-10 p.m anyday and I will send it to you via any transport company close to you in Nigeria..( This offer is only for Nigerians)

EurUsd sell signal

This pair rose from 1.3500 last week and having seen a worse NFP data, I was expecting this pair will thrive to 1.3700

A pin bar was formed on Tuesday altering the full bullish move. This pin was confirmed yesterday by a full bearish candle

I will sell on pending order @ 1.3615 and put my stop loss @ few pips above the high of the pin and target 1.3510

Wednesday, February 12, 2014

Will the bears take over Audchf?

I discussed a pin bar forming on a falling counter trendline which has been re-established and I percieved strong . I took the trade and my first profit target was hit on 50% of my account, I reduced my stop loss to 50% and the other 50% of my account was hit giving me a little profit of 31pips in total.

Price has since moved up and broke the pin bar to retest the falling trendline I discussed. A doji was formed today and I will wait till tommorow expecting a good bearish candle to confirm before locating a good level to sell. If price broke the trendline upward with a full bullish candle, I will have to come back another day

EurAud mid-week Review

The trade I took last week due to a clear bullish pin formed at 1.5035 support was closed on monday with a profit of 125 pips due to a percieved clear pin formed at a tiny critical point that needs an eagle eye to view.

So the market didn't reach my profit level at 1.5450. I didn't take a sell because of the ECB president speech that was to be delivered today and given the fact that the level wasn't that signifant to my eyes.

I just saw it as an opportunity to exit a winning trade. We will see how this market reacts at the present level, whether it's going to break it or continue the upward trend

The level now is very critical, I will watch out

Audusd forming a DOJI @ a critical level

In my previous post on this pair, I recognised 0.9100 and thereabout as my trading level.

In the past 3 days, this pair has continued its retracement from 24th January low and a bearish movement is imminent

With a DOJI formed today a little below 0.9100, the bears might be gathering momentum to push the market down. I will wait for a full bearish candle to form at the end of tommorow close.

If that should happen, I will sell and hope I can make a good return at 0.8845 and 0.8710 and if otherwise, I will simply wait if a breakout will happen or price simply wants to touch 0.9100

I will keep you updated tomorrow...

Sunday, February 9, 2014

EurAud weekly outlook...10th-14th February 2014

A pin bar was formed at a strong support region (1.5055) and I opened a buy order. I was making 95 pips before the close of market last week

I expect this market at 1.5450 this week or early next week

If the market reverses downward and breaks the 1.5055 support then we'll be looking at 1.4540.

This pair has been bullish since November 2013.

I will keep you updated as the market unfolds itself in the coming trading days.

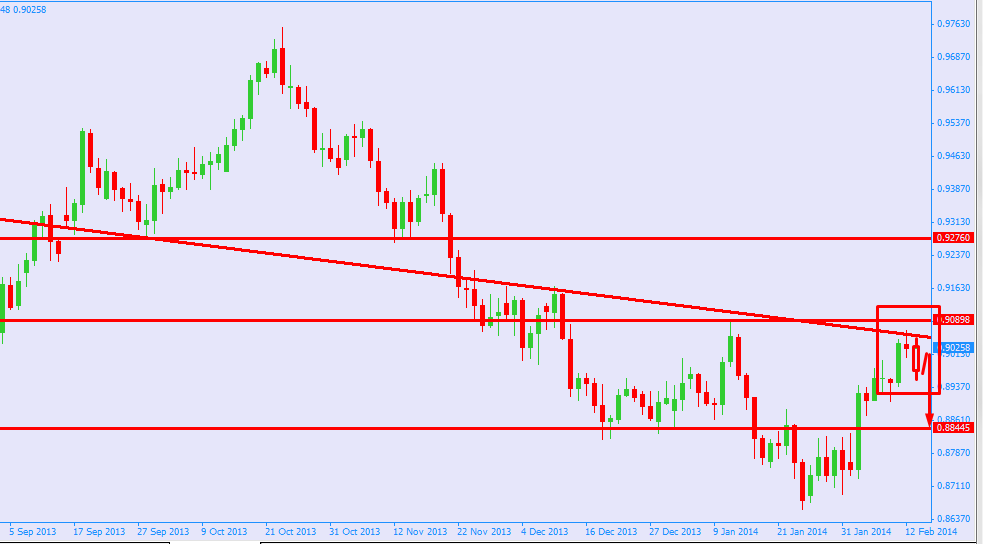

AudUsd weekly outlook...10th-14th February, 2014

This pair has been in a down trend from October 2013, reversed to form a strong resistance at 0.9100

With a worse than expected non-farm payroll data released from US last week, I expext this pair to move to 0.9100 which was formed by a horizontal resistance line and a counter trendline.

I will expect price action bounce around this level before the bearish trend will continue

Conversely, if 0.9100 is broken to the upside, I will wait for a reversal price action signal to push to 0.9300

In the main time, I will make 0.9100 my trading point

USDCHF Weekly Outlook 10th-14th February 2014

This pair, after the pin bar-orchestrated bear move from 0.9135, reversed upside to test 0.9135.

0.9135 wasn't reached due to the bearish engulfing candles pattern formed and the market ended last week on a bearish mood strenghtened by a worse than expected non-farm payroll data

This pair could bounce off the 0.8850 support level ( combination of trendline and horizontal support).

I will watch price action at 0.8850 if the market gets there

Otherwise, if the market turns upside, I will watch for price action at 0.9135 resistance which is made stronger by negative slope trendline

KEY LEVELS TO WATCH OUT FOR

Resistance Level 0.9130 Support Level 0.8850

I will keep you updated as this market unfolds in the course of the week

EURUSD Weekly Analysis: 10th to 14th Feb 2014

After making 150 pips from this pair last week due to a candles reversal pattern formed around the 1.3700 where we saw a movement to 1.3500 support level.

A reversal inside bar was formed after the market broke the trendline support (which was made stronger by the support formed earlier last week), and we see this pair immediately moved up, helped by a worse than expected non-farm payroll data released from the United states on Friday.

1.3700 is the next level to target where we could see a bounce to sell or a breakout toward 1.3830 resistance.

LEVELS TO WACTH OUT FOR

Support levels___________ 1.3480 and 1.3320

Resistance Levels____________ 1.3700 and 1.3830

I will keep you updated as the trade unfolds

Thursday, February 6, 2014

AUDCHF sell signal

This pair reversing upward after a sharp movement from 0.8197 to 0.7722, could resume downward bearish trend that started from 0.8730

The resumption of the bears is based on the daily pin bar about to be formed at 0.8120-0.8197 resistance region which also coincides with the bearish trenline that started on october 2013

If this pin bar is successfully formed at the end of the trading day and it's not far away from 0.8700, I will sell at market price with my stop loss slighly above today's high ( i.e the high of the pin bar) and take profits at 0.7900 and 0.7750

If you are following this trade , please maintain proper money management

Subscribe to:

Posts (Atom)