On 21st December 2015, we posted an analysis on Gold. We noted the end of an impulse wave from1920.50. The 5th wave of the impulse being an ending diagonal.

Price rallied fast in the early months of 2016 just as expected. You can read the analysis here.

The break out of the diagonal was fast and an impulse wave. Price was short of 1300.46 ( our final immediate target) and started declining, signifying the end of the well-formed bullish impulse wave.

After such an impulse wave, a 3-wave correction (decline in this case) is a no-brainer according to Elliott wave theory.

The emerging corrective pattern is our duty to figure out.

In the chart below, there is a good likelihood that the corrective pattern could be a double zigzag which could be as deep as 1170.70-1146.08 levels ( good confluence zone ).

The 'X' wave of the probable zigzag could be a triangle pattern.

The chart below shows the triangle in a lower time frame.

If price completes the last two legs of the triangle as shown and held below 1242 price level, it has a good chance of declining to 1170.70-1146.08.

This analysis is a forecast and will require price to commit to it before we commit ourselves to considering its bearish outcome.

Let's alert you of the completion and any alternatives.

Price rallied fast in the early months of 2016 just as expected. You can read the analysis here.

The break out of the diagonal was fast and an impulse wave. Price was short of 1300.46 ( our final immediate target) and started declining, signifying the end of the well-formed bullish impulse wave.

After such an impulse wave, a 3-wave correction (decline in this case) is a no-brainer according to Elliott wave theory.

The emerging corrective pattern is our duty to figure out.

In the chart below, there is a good likelihood that the corrective pattern could be a double zigzag which could be as deep as 1170.70-1146.08 levels ( good confluence zone ).

The 'X' wave of the probable zigzag could be a triangle pattern.

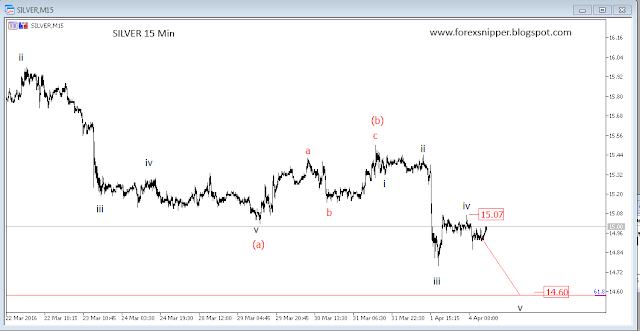

The chart below shows the triangle in a lower time frame.

If price completes the last two legs of the triangle as shown and held below 1242 price level, it has a good chance of declining to 1170.70-1146.08.

This analysis is a forecast and will require price to commit to it before we commit ourselves to considering its bearish outcome.

Let's alert you of the completion and any alternatives.