There is more to successful trading than buying and selling.

Successful trading requires a lot of patience, hardwork, discipline, persistence and very important; READINESS which is preceded by PREPARATION.

PREPARATION is an essential ingredient that is needed in any endeavor. The best prepared mind wins. The same applies to trading.

Lack of preparation leads to FAILURE.

In trading, preparation should be done before the markets open for the new trading week. An army gets itself prepared before the war not during the war.

There are more than 30 currency pairs (minor and major) , excluding the exotic pairs, that can be traded in the FOREX market.

Out of these 30, there are like 7 or 8 major. Following only the majors will result in having few trades especially for a swing or position trader; though trading ONLY the majors will encourage FOCUS.

Looking for more trades will require that a trader involves in more pairs; there are more than 30 after all. But the question is : how does a trader manage more than 30 pairs without losing focus and engaging in over-trading?

It's down to one thing: preparing before the market opens for the new trading week by having a WATCH LIST.

After doing much analysis, in our own case here- Elliott wave analysis; one can see vividly which of the pairs is forming a well-recognizable wave pattern in the nearest term such that a trading opportunity can emerge in the course of the week.

At the end of this exercise, we can narrow our thoughts to these pairs which could be 10 or less or slightly more.

We can then fill our work space with these pairs and watch through out the week; making forecasts, projections and waiting for price to validate or invalidate and finally waiting for all parameters to be met before pulling the trigger.

This will make our work to be much easier, exciting and relaxing. No pressure, no sentimental bias- we just wait wait for price t be in tune, measure our risk and then pull the trigger. Trading should be that simple.

I have 9 currency pairs in my

WATCH LIST for the new trading week: 19th-23rd September 2016. I decide to share with you.

1. AUDCAD

I have a very strong bearish bias for this pair. The bearish correction which started Mid-August may have not completed yet. A 5-wave decline is expected. I will consider a short trade if price breaks below the rising trendline supporting sub-wave ii. This move could be invalidated if price rallies above wave

(b).

2. AUDUSD

After the much awaited decline started about 2 weeks ago, price may continue going downside in the coming months. I want to see a corrective rally (wave ii) to 0.76 price region before I join the bears once more for a move that could even be greater than the current bearish move. Of course, price may continue downside without a rally to the aforementioned region but I still expect a deep correction upside.

3. CADJPY

If you are consistent follower of this blog, you'd see that price followed the second scenario as mentioned in

this post. A 5-wave.

A 5-wave decline is almost complete. We may see a bullish reversal this week. It will be a corrective move ,wave ii. I usually trade wave ii (if wave i is large enough and completes a very good pattern) because they are often sharp deep counter move (61.8% of wave i) and are not often complex unlike wave iv.

If the diagonal mouth completes and price breaks upside, I will consider a bullish trade though the general bias is bearish.

4. EURAUD

This is a typical example of what I mentioned above that wave 2 are often sharp moves. After the rally that broke above 1.4710 which I notified us about, read

here , there was a clear indication that a real dip would happen as wave ii are very sharp moves. This bearish correction may not be over yet. I will look forward to price falling deeper to 1.47/48 region before considering a bullish opportunity. I still maintain a bullish bias after the correction is over.

5. EURGBP

In an earlier post we forecast a 5-wave dip and discussed about an imminent correction upside in a later video analysis. Price is currently correcting the dip (a very sharp move). Price is now at a turning point with a presumed diagonal. If the rally steps down and the diagonal mouth is well formed. We may see stronger dip. Price is expected to be contained below 0.86. Any strong rally above this level could abort the bearish expectation.

6. EURNZD

This move is similar to the Euraud move. Price may dip further to 1.51-52 region before the preceding rally continues.

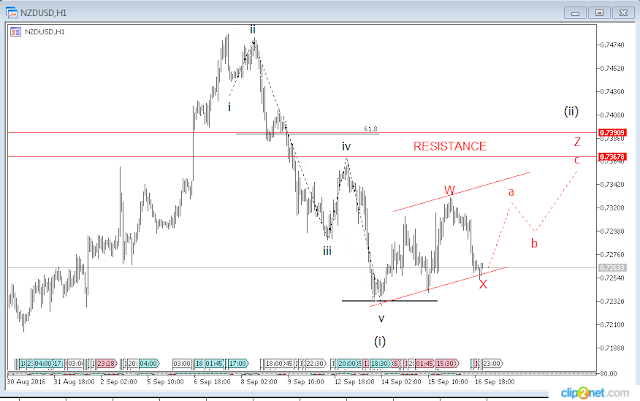

7. NZDUSD

Like Audusd, the correction may go further upside in a double zigzag formation, though the X wave is fast. A dip below 0.72 will invalidate this view and the bearish decline will continue. To consider a short opportunity at this juncture, I will wait for price to rally to the resistance level (0.73-0.74). Many other things can happen but as they happen, we can adjust our analysis and forecast in order to take good position that encourage good R/R.

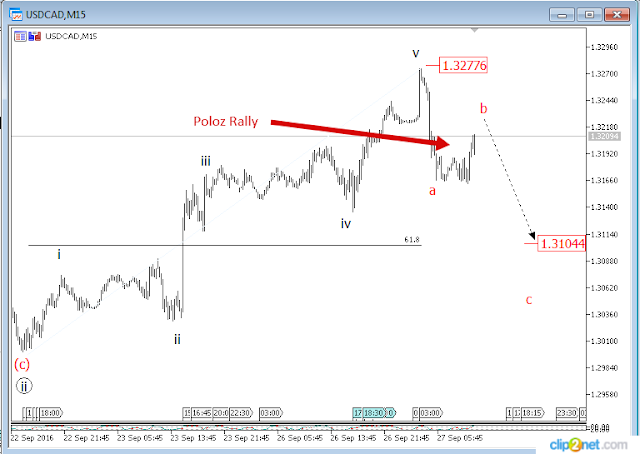

8. USDCAD

In a

Mid-week forecast, I alerted us of a complete triangle pattern and we joined the rally and what a good rally it was!

Now, do we see a decline?. Yes, it's imminent. A 5-wave with a diagonal mouth is a no-brainer to me.

If the diagonal completes as forecast and breaks below as indicated, we may see price declining back to the triangle.

And Finally......

8. UsdJpy.

I thought the rally after the last bearish move would be a 5-wave kind

but with a triangle forming, we may see an ABC correction upside before

the larger degree bearish move continues.

We are interested in the (c) wave to 106 price level. If the triangle is complete as shown in the chart, we will have a good reason to consider a long trade to 106.25.

All these are forecasts that price has to validate or invalidate. Patience and strict discipline is needed. There is no guarantee that price will move this may. Price can move in many other ways.

It's good to have an expectation for price move using well-tested tools like Elliott wave theory.

Creating analytical watch list like this will only help us take relaxed and well planned decisions.

Fundamental Activities To Watch out for

Tuesday: Monetary Policy Meeting in Australia (AUD)

Wednesday: 1. Monetary Policy Statement in Japan and Bank of Japan press conference (JPY)

2. FOMC statements and Funds rate in the U.S (USD)

3. Rate statement in New Zealand (NZD)

Thursday: 1. Unemployment Claims in U.S (USD)

2. European Central Bank President Draghi speech (EUR)

Friday: Core CPI and Retail Sales in Canada (CAD)

All these activities will surely affect our forecast. They will probably (actually they often) drive price to our positions and we have to wait and be patient.

I will be discussing these watch list in a webinar on Monday. I invite you to join me in the analysis, forecast, question and answer webinar. It's going to be interesting and educating.

INVITATION TO WEBINAR

https://global.gotomeeting.com/join/111588125

Date: Monday, 19th September, 2016

Time: 9:00 am Gmt or 10:00 a.m Central African Time

Use your microphone and speakers (VoIP) - a headset is recommended. Or, call in using your telephone.

Dial +1 (872) 240-3311

Access Code: 111-588-125

Audio PIN: Shown after joining the meeting

Meeting ID: 111-588-125

Not at your computer? Click the link to join this meeting from your iPhone®, iPad®, Android® or Windows Phone® device via the GoToMeeting app.