On 16th February, I did a video analysis pointing at a long term flat pattern emergence. See here .

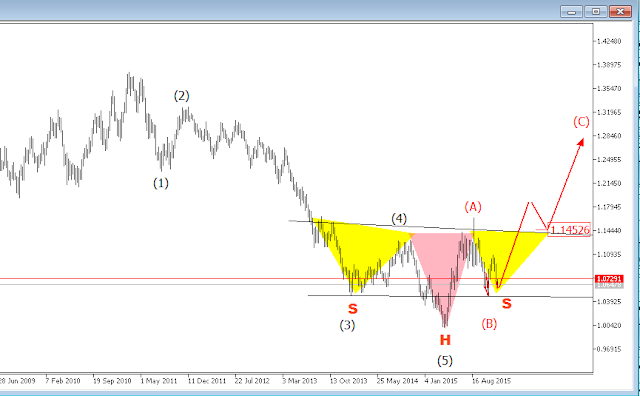

The chart above was used in the analysis.

Price is projected to move in a motive wave and the first wave is still in motion, probably in the final phase i.e the fifth sub-wave.

With price projected to dip to the 70 price region with about 600 pips away and a motive wave, an impulse wave or an ending diagonal.

The video below explained further how price could move.

The second sub-wave of the fifth wave is complete and price is in motion to complete the third wave.

See the chart below

The chart above shows how the third wave of the 5th sub-wave is emerging. A combination of zigzag pattern followed by two different flat patterns shows that the recent intra day bullish drive will soon be exhausted for the bearish trend to continue in journey that could get to 70 price level.

The chart below shows the plan.

Subscribe to our mailing list to send the alert to you.

The chart above was used in the analysis.

Price is projected to move in a motive wave and the first wave is still in motion, probably in the final phase i.e the fifth sub-wave.

With price projected to dip to the 70 price region with about 600 pips away and a motive wave, an impulse wave or an ending diagonal.

The video below explained further how price could move.

The second sub-wave of the fifth wave is complete and price is in motion to complete the third wave.

See the chart below

The chart above shows how the third wave of the 5th sub-wave is emerging. A combination of zigzag pattern followed by two different flat patterns shows that the recent intra day bullish drive will soon be exhausted for the bearish trend to continue in journey that could get to 70 price level.

The chart below shows the plan.

Subscribe to our mailing list to send the alert to you.