Wednesday, December 23, 2015

Monday, December 21, 2015

Gold Rally Is Imminent: How Prepared Are You?

Since 2011, Gold has been on a free fall from $1920.5 per ounce and now, only been supported by a psychological $1000 price level.

I labelled the rise to $1920.5 a 5-wave impulse.

From a larger forecasting point of view, Gold might still fall in the future to $671.11 after an expected rally to $1450-1500 price levels. All these will be, if the correction from $1920.50 will be a deep or complex zigzag corrective pattern.

Of course, we can always adjust our analytical forecast as price determines evolving patterns.

Right now, what we see is a clear 5-wave fall from $1920.50 which is labelled as the first leg of the correction of the impulse wave that ended in September 2011.

The weekly chart below shows this clearly.

The second leg, a prospective 3-wave rally, is expected to end around $1450-1500 price levels.

More so, the fifth wave of the impulse dip from $1920.50 is a clear ending diagonal pattern which gives us more confidence as to the expected rally. This is shown in the daily chart below.

$1000, a psychology price level, is expected to hold as a support. A dip below it could hamper the price of Gold going up.

A break above $1100.35 should trigger a long trade as price is expected to break above $1193.7 and to $1300.46 in the medium term.

Send your request to Forexmaster05@yahoo.com

I labelled the rise to $1920.5 a 5-wave impulse.

From a larger forecasting point of view, Gold might still fall in the future to $671.11 after an expected rally to $1450-1500 price levels. All these will be, if the correction from $1920.50 will be a deep or complex zigzag corrective pattern.

Of course, we can always adjust our analytical forecast as price determines evolving patterns.

Right now, what we see is a clear 5-wave fall from $1920.50 which is labelled as the first leg of the correction of the impulse wave that ended in September 2011.

The weekly chart below shows this clearly.

The second leg, a prospective 3-wave rally, is expected to end around $1450-1500 price levels.

More so, the fifth wave of the impulse dip from $1920.50 is a clear ending diagonal pattern which gives us more confidence as to the expected rally. This is shown in the daily chart below.

$1000, a psychology price level, is expected to hold as a support. A dip below it could hamper the price of Gold going up.

A break above $1100.35 should trigger a long trade as price is expected to break above $1193.7 and to $1300.46 in the medium term.

Let's alert you of high confidence trade set ups. Join a group of happy traders who have been receiving our trade signals both free and premium. We made over 2000pips last month.

Wednesday, December 16, 2015

Audnzd: What We Expect Next

As a technical analyst, it's essential to learn different technical approaches to market prices.

Elliot wave theory, chart pattern analysis, fibonacci harmonic analysis, candlestick price action are some of the effective elements of technical armory every chartist must equip himself with.

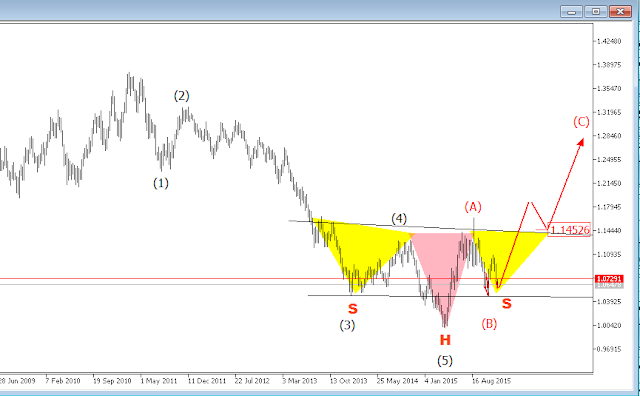

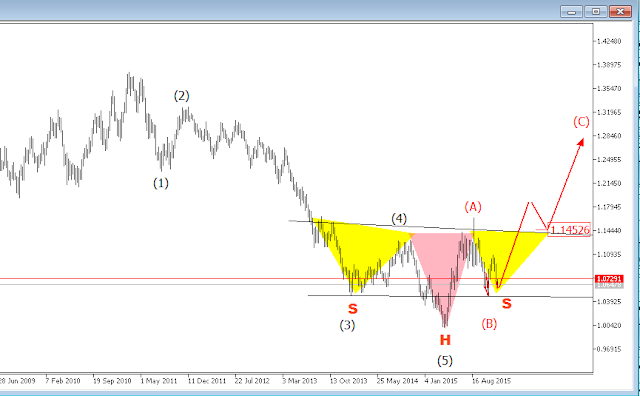

On October 29th, an analysis was posted here on Audnzd titled Audnzd: Upward trend to continue?. We discussed about a 5-wave bearish elliot wave impulse pattern as seen on the weekly chart.

After the end of the impulsive wave, a 3-wave correction , as expected, seems to have started as price rallied from 2015 low.

We narrowed down our elliot wave count to the hourly chart as we got a bullish trade set-up which we quickly shared with our subscribers.

All our profit targets were hit; though we were forced to close some of our trade before the final target due to a bearish reversal warning in the article titled: Audnzd: A Technical Combination.

Price rallied further, hit all targets and started falling as expected.

Will this fall continue or price will resume the rally?

The chart below is the recent weekly chart.

There is a prospective inverted head and shoulder reversal chart pattern subsumed in what could be a complete elliot wave cycle.

A complete elliot wave cycle is a 5-wave impulse trend wave followed by a 3-wave correction in the opposite direction of the trend.

With our wave count, we presume that price is still in the wave-C of the correction expected and the second wave of the C-wave is expected to end soon.

The 2nd wave of wave-C is a hourly tripple zigzag corrective pattern supported by a confluence zone.

If price is contained above 1.05 and rallied to break above 1.077, we will be prepared to get in line with a long position aiming 1.1548 as the final future price level.

Join us as we ride the trend together.

Our free signal service started last month with a 100% wins on 5 trades profiting about 2000pips.

You can take control of your trades and funds with our analysis and signals as an aggressive or conservative trader.

Send your E-mail address and phone number to forexmaster05@yahoo.com

Elliot wave theory, chart pattern analysis, fibonacci harmonic analysis, candlestick price action are some of the effective elements of technical armory every chartist must equip himself with.

On October 29th, an analysis was posted here on Audnzd titled Audnzd: Upward trend to continue?. We discussed about a 5-wave bearish elliot wave impulse pattern as seen on the weekly chart.

After the end of the impulsive wave, a 3-wave correction , as expected, seems to have started as price rallied from 2015 low.

We narrowed down our elliot wave count to the hourly chart as we got a bullish trade set-up which we quickly shared with our subscribers.

All our profit targets were hit; though we were forced to close some of our trade before the final target due to a bearish reversal warning in the article titled: Audnzd: A Technical Combination.

Price rallied further, hit all targets and started falling as expected.

Will this fall continue or price will resume the rally?

The chart below is the recent weekly chart.

There is a prospective inverted head and shoulder reversal chart pattern subsumed in what could be a complete elliot wave cycle.

A complete elliot wave cycle is a 5-wave impulse trend wave followed by a 3-wave correction in the opposite direction of the trend.

With our wave count, we presume that price is still in the wave-C of the correction expected and the second wave of the C-wave is expected to end soon.

The 2nd wave of wave-C is a hourly tripple zigzag corrective pattern supported by a confluence zone.

If price is contained above 1.05 and rallied to break above 1.077, we will be prepared to get in line with a long position aiming 1.1548 as the final future price level.

Join us as we ride the trend together.

Our free signal service started last month with a 100% wins on 5 trades profiting about 2000pips.

You can take control of your trades and funds with our analysis and signals as an aggressive or conservative trader.

Send your E-mail address and phone number to forexmaster05@yahoo.com

Wednesday, December 2, 2015

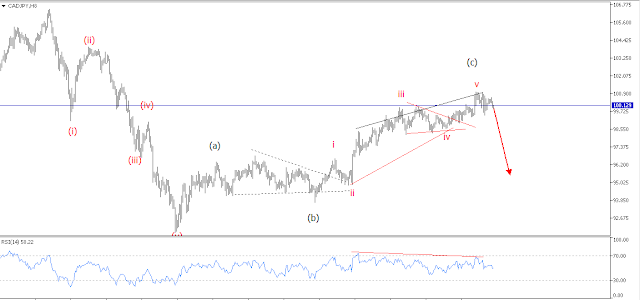

AudJpy May Continue Downside

We have been watching the long term historical activities of this pair for some time now but waiting for the right moment to follow the bearish trend move.

The move from 55.23 (in year 2000) to 108.275 ( in year 2007) was a clear 5-wave impulse (as illustrated in the chart below).

After such a move, one would expect a 3-wave correction (according to elliot wave theory). The corrections, though varying and complex in nature, are easy to spot.

The good thing about trading the elliot wave theory is that short term opportunities can be spotted within a large time frame and still following all the rules and guidelines of the wave theory. One can forecast a long term market move and trade clear patterns in the direction of the trend.

From 108.275 to 54.91 wave w ( a 3-wave decline) and back to wave x at 105.4 (a 3-wave rally), one can anticipate a double zigzag decline in labelled (W,X,Y in blue) which could end at 55 price level or below.

How can we take advantage of this forecast?, we can go to a lower time frame and read wave theory and price activities using combinations of technical tools.

The decline from 103.46 has completed the first leg of a double zigzag pattern and now correcting to 91.2 region. We expect price to be contained below 91.27 below the falling trendline. There is so much fibonacci ratios converging in that region. We expect it to be strong enough to keep the correction exhausted.

If there is a short opportunity below 91.27, a good ride could happen as we follow price decline further to 71.86

Let's alert you of any trading opportunity we spot.

You can send your E-mail address to Forexmaster05@yahoo.com for high probability forex signals.

The move from 55.23 (in year 2000) to 108.275 ( in year 2007) was a clear 5-wave impulse (as illustrated in the chart below).

After such a move, one would expect a 3-wave correction (according to elliot wave theory). The corrections, though varying and complex in nature, are easy to spot.

The good thing about trading the elliot wave theory is that short term opportunities can be spotted within a large time frame and still following all the rules and guidelines of the wave theory. One can forecast a long term market move and trade clear patterns in the direction of the trend.

From 108.275 to 54.91 wave w ( a 3-wave decline) and back to wave x at 105.4 (a 3-wave rally), one can anticipate a double zigzag decline in labelled (W,X,Y in blue) which could end at 55 price level or below.

How can we take advantage of this forecast?, we can go to a lower time frame and read wave theory and price activities using combinations of technical tools.

The decline from 103.46 has completed the first leg of a double zigzag pattern and now correcting to 91.2 region. We expect price to be contained below 91.27 below the falling trendline. There is so much fibonacci ratios converging in that region. We expect it to be strong enough to keep the correction exhausted.

If there is a short opportunity below 91.27, a good ride could happen as we follow price decline further to 71.86

Let's alert you of any trading opportunity we spot.

You can send your E-mail address to Forexmaster05@yahoo.com for high probability forex signals.

Monday, November 23, 2015

All Eyes On GbpChf

In the last update on Gbpchf, (read) we were expecting price to rally in 3-wave to complete an ending diagonal which is meant to be the wave C of a larger degree flat corrective pattern.

It was maintained that

A conservative long term trader can look for a bearish opportunity as price breaks below 1.4800 ( i.e the wave2-4 trendline)

An aggressive short term trader may enter earlier at the break of 1.5350 to ride to 1.4950 and below 1.4800.

Get free and high probablity trading signals and analysis forward your the E-mail address and mobile phone number.

To get started;

Send your mail and phone number.

Forexmaster05@yahoo.com

It was maintained that

If price is contained below 1.5600 and breaks below the trendline connecting wave 2 and 4 of the diagonal, there will be an opportunity to put a long term sell order to ride to 1.38 and below.With a probable completion of the pattern, there is a high likelihood of a long term bearish move especially if price is maintained below 1.56.

A conservative long term trader can look for a bearish opportunity as price breaks below 1.4800 ( i.e the wave2-4 trendline)

An aggressive short term trader may enter earlier at the break of 1.5350 to ride to 1.4950 and below 1.4800.

Get free and high probablity trading signals and analysis forward your the E-mail address and mobile phone number.

To get started;

Send your mail and phone number.

Forexmaster05@yahoo.com

Sunday, November 15, 2015

Will GbJpy crash again?.....And when?

The ending diagonal is one of the elliot wave patterns that I so delight in.

It shows a large reversal in the prevailing trend or counter-trend. The joy of watching price breaking the lower trendline (in a bullish market) and the upper trendline (in a bearish market) is characteristically fast and overwhelming.

On 13th august, I posted an analysis on GbpJpy where the fall in mid-august and early september were so pronounced. The analysis is titled GbpJpy: When will the bears take over? . It's a must read.

Just as the forecast was done, price fulfilled all the conditions and fell sharply.

After the fall, I tried to wonder what drives the diagonals. I posted the analysis titled : What drive the diagonals? on 23rd august. You may want to read it also.

The chart below shows the price movement after the diagonal price formation.

The chart above shows that price is moving in a 3-wave corrective pattern after the motive wave that broke the diagonal downside. There could still be more room for the bears to ride the price.

The yellow region 188.80 and 190 (a confluence zone) is projected for price to complete the correction.

We could see price at this zone after which a crash will be expected.

Price is expected to be contained below 190 for any chance for the bears in the nearest time.

Just forward to forexmaster05@yahoo.com with the message title "signal"

It shows a large reversal in the prevailing trend or counter-trend. The joy of watching price breaking the lower trendline (in a bullish market) and the upper trendline (in a bearish market) is characteristically fast and overwhelming.

On 13th august, I posted an analysis on GbpJpy where the fall in mid-august and early september were so pronounced. The analysis is titled GbpJpy: When will the bears take over? . It's a must read.

Just as the forecast was done, price fulfilled all the conditions and fell sharply.

After the fall, I tried to wonder what drives the diagonals. I posted the analysis titled : What drive the diagonals? on 23rd august. You may want to read it also.

The chart below shows the price movement after the diagonal price formation.

The chart above shows that price is moving in a 3-wave corrective pattern after the motive wave that broke the diagonal downside. There could still be more room for the bears to ride the price.

The yellow region 188.80 and 190 (a confluence zone) is projected for price to complete the correction.

We could see price at this zone after which a crash will be expected.

Price is expected to be contained below 190 for any chance for the bears in the nearest time.

Get market analysis and signal to your phone number or E-mail address.

AudNzd: A Technical Combination!

In the last update on Audnzd I used different technical analysis, headed by the elliot wave theory, to forecast a probable upward move.

There was a condition for a bullish opportunity.

There was a condition for a bullish opportunity.

Price could trace down a bit before rallying to break the upper trendline upside. This will be a trading opportunity to buy this pair with a good risk/reward ratio.There could be a trading opportunity to ride wave C to 1.2175

Tuesday, November 10, 2015

Gbpchf: The Long Term View

From the monthly chart below, it can be seen that Gbpchf has declined in 3-waves from 2.7328 to 1.13825 in a move that lasted for more than a decade.

The move is expected to be an impulse wave.

The rally from 1.13825 (2011 low) is expected to be the 4th wave of the impulse. Price has tried many times to break above 1.5600, which has now become a strong resistance.

The 4th wave which began at 1.13825 (2011 low) is getting set to complete a flat corrective pattern.

Flat patterns, according to elliot wave theory, are 3,3,5 patterns; the first wave wave is corrective (3-wave), the second wave is also corrective (3-wave) while the terminating wave (5-wave) is a motive wave (impulse wave or ending diagonal).

The weekly chart below shows the internal/building waves of this 4th wave.

The terminal wave of the flat correction is completing an ending diagonal. The 5th wave of the diagonal will be expected to be a 3-wave as indicated in the chart below.

If price is contained below 1.5600 and breaks below the trendline connecting wave 2 and 4 of the diagonal, there will be an opportunity to put a long term sell order to ride to 1.38 and below.

The move is expected to be an impulse wave.

The rally from 1.13825 (2011 low) is expected to be the 4th wave of the impulse. Price has tried many times to break above 1.5600, which has now become a strong resistance.

The 4th wave which began at 1.13825 (2011 low) is getting set to complete a flat corrective pattern.

Flat patterns, according to elliot wave theory, are 3,3,5 patterns; the first wave wave is corrective (3-wave), the second wave is also corrective (3-wave) while the terminating wave (5-wave) is a motive wave (impulse wave or ending diagonal).

The weekly chart below shows the internal/building waves of this 4th wave.

The terminal wave of the flat correction is completing an ending diagonal. The 5th wave of the diagonal will be expected to be a 3-wave as indicated in the chart below.

If price is contained below 1.5600 and breaks below the trendline connecting wave 2 and 4 of the diagonal, there will be an opportunity to put a long term sell order to ride to 1.38 and below.

Thursday, October 29, 2015

AudNzd: Upward Trend To Resume?

The bearish trend from 2011 was a clear impulse wave.

According to elliot wave theory, a 3-wave correction often follows a 5-wave trend. These corrections have different patterns; one of which is the zigzag pattern.

The 5-wave impulse in Audnzd ended and immediately started the 3-wave correction in April 2015.

According to elliot wave theory, a 3-wave correction often follows a 5-wave trend. These corrections have different patterns; one of which is the zigzag pattern.

The 5-wave impulse in Audnzd ended and immediately started the 3-wave correction in April 2015.

Tuesday, October 27, 2015

Usdcad Taking One More Push Upside?

The price of Usdcad is predominantly determined by the crude oil markets. The negative correlation between them is so strong that as soon as oil price begins to fall, Usdcad immediately begins the rise in almost similar manner.

Since 2011, the trend of Usdcad has generally been bullish in what should be an impulse wave C of a cycle corrective ABC.

The C wave may have peaked at 1.3435 (100% fibonacci projection of wave A from B) but the impulse pattern doesn't look completed yet.

Price is probably in the 4th wave (a RUNNING FLAT corrective pattern shown in yellow) of the 5th wave of this impulse wave.

Since 2011, the trend of Usdcad has generally been bullish in what should be an impulse wave C of a cycle corrective ABC.

The C wave may have peaked at 1.3435 (100% fibonacci projection of wave A from B) but the impulse pattern doesn't look completed yet.

Price is probably in the 4th wave (a RUNNING FLAT corrective pattern shown in yellow) of the 5th wave of this impulse wave.

Thursday, October 8, 2015

GbpJpy To Continue Downward?

The fast fall in the GbpJpy had been forecast after a very powerful reversal pattern showed up- I call the pattern the 'pregnant diagonal' i.e a diagonal pattern ending a larger degree diagonal pattern. You can read the forecast GBPJPY

And then read how price react later after the pattern completed GBPJPY

The fall was fast just as expected knowing that a diagonal is often followed by a fast counter move to its starting point.

And then read how price react later after the pattern completed GBPJPY

The fall was fast just as expected knowing that a diagonal is often followed by a fast counter move to its starting point.

Monday, October 5, 2015

Continuation Of Eurusd Bullish Correction. How probable?

It's been long that I haven't updated on this pair. The last analysis titled Eurusd Intraday Update was about how far price has reacted after the rise from 1.046.

Price from 1.046 is clearly engaging in a correction after a long term bearish move. The correction was expected to be a double zigzag pattern

Price from 1.046 is clearly engaging in a correction after a long term bearish move. The correction was expected to be a double zigzag pattern

Thursday, August 27, 2015

Eurusd Intraday Update

Over the week, price has reached our forecast target at 1.6-1.7 and immediately reacted there as it dipped in what looks like a correction.

The alternate medium-term triangle projection did not hold and we can still stay with our original forecast of a {WXY} double zigzag correction of the bearish move that ended at 1.045 in March.

Tuesday, August 25, 2015

Follow the Gold Market

In the early stage of this millennium, we have seen Gold very valuable commodity as it made a record high at $1920 per ounce. It was a clear impulse wave ( a strong trend).

According to the Elliot wave theory, price corrects in 3-waves after trending in 5-waves.

The sell off which started in 2011 after the record high should be a 3-wave correction. There are a number of corrective patterns as described by Elliot Wave Principle. One of these patterns is the Zigzag pattern.

According to the Elliot wave theory, price corrects in 3-waves after trending in 5-waves.

The sell off which started in 2011 after the record high should be a 3-wave correction. There are a number of corrective patterns as described by Elliot Wave Principle. One of these patterns is the Zigzag pattern.

Monday, August 24, 2015

EurUsd New Outlook

On 4th August, I posted a forecast titled Eurusd about to complete a triangle on Eurusd based on elliot wave analysis and followed the intraday moves on the Eurusd Intraday Analysis page.

The conclusive paragraphs of this analysis are quoted below.

The conclusive paragraphs of this analysis are quoted below.

"The [X] leg of the prospective double zigzag is about to complete a triangle (an elliot wave corrective pattern) and a break above the B-D triangle line will validate a move to advance Eurusd to 1.16-1.18.Price is expected to complete the last leg of the triangle which should end at 1.081. A break below this level will invalidate the entire forecast."

Sunday, August 23, 2015

EurAud Could be Exhausted Upside: Imminent Sell Off.

The price movement from 1.3655 in April 2015 after the completion of a diagonal pattern highlighted how important elliot wave patterns could be. The bullish move should never be mistaken for an impulse wave.

The fact that component waves are 3-waves shows that the entire movement is not impulse not to talk of how the entire movement was perfectly placed in a channel (which is not common to Impulse waves).

The pattern was forecast to be a triple zigzag (often formed within a channel) in the Intra-day analysis of Euraud.

Elliot wave stated clearly that after a corrective pattern, a motive wave should follow and if this pattern will hold, we might see price falling in months to come.

Meanwhile, price could go a bit higher but should be contained below 1.5700-50 before the sell off.

We are prepared to follow through: you can join the daily updated Intra day analysis of Euraud.

The fact that component waves are 3-waves shows that the entire movement is not impulse not to talk of how the entire movement was perfectly placed in a channel (which is not common to Impulse waves).

The pattern was forecast to be a triple zigzag (often formed within a channel) in the Intra-day analysis of Euraud.

Elliot wave stated clearly that after a corrective pattern, a motive wave should follow and if this pattern will hold, we might see price falling in months to come.

Meanwhile, price could go a bit higher but should be contained below 1.5700-50 before the sell off.

We are prepared to follow through: you can join the daily updated Intra day analysis of Euraud.

What Drive The Diagonals?

The diagonal pattern is one of the 2 motive waves discussed by the elliot wave theory. The diagonal is so often followed by a fast and high momentum breakout that it has become its 'after-formation' characteristic.

But, what drive the diagonals to behave so?

The close of trades of UsdJpy and GbpJpy last week showed clearly how price responds after a diagonal pattern has formed.

In the last post on GbpJpy titled GbpJpy: When Will The Bears take Over , I quoted thus:

But, what drive the diagonals to behave so?

The close of trades of UsdJpy and GbpJpy last week showed clearly how price responds after a diagonal pattern has formed.

In the last post on GbpJpy titled GbpJpy: When Will The Bears take Over , I quoted thus:

"If price is contained below 195.755 and breaks 193.34, price could

start a big fall to 190.863 (in the short term) and 173.553 as the final

'after-diagonal' price reaction target."

Thursday, August 13, 2015

Wednesday, August 12, 2015

Monday, August 10, 2015

Gbpusd: The Clear Picture.

In the LAST UPDATE on this currency pair, I wrote about a long term bearish bias. I also mentioned that in the hourly charts we might see some bullish move (especially if the rising trendline is not broken downside) before the bearish trend resumes.

A double zigzag correction to 1.65 was expected though the 'B' wave pattern of the zigzag was not so clear.

The 'B' wave now seem to form a triangle.

Price is expected to break above 1.571 to confirm the triangle formation.

In order for the triangle pattern to hold, price should not break below the ACE support line of the triangle.

Triangle patterns , according to elliot wave theory usually precede the end of a trend or correction. The formation of this triangle could mean that the correction upside is not over yet.

A double zigzag correction to 1.65 was expected though the 'B' wave pattern of the zigzag was not so clear.

The 'B' wave now seem to form a triangle.

Price is expected to break above 1.571 to confirm the triangle formation.

In order for the triangle pattern to hold, price should not break below the ACE support line of the triangle.

Triangle patterns , according to elliot wave theory usually precede the end of a trend or correction. The formation of this triangle could mean that the correction upside is not over yet.

Thursday, August 6, 2015

The Long Journey of Euraud

The long term cycle impulse wave from 2.1144 in 2008 to 1.1514 in 2012 is expected to be followed by a 3-wave correction of the same degree ( according to the wave principle).

The first leg of this correction ended in a 5-wave impulse primary wave and it's also expected to correct in 3-waves of the same degree which I once forecast to end at 1.3250 before the diagonal that formed at 1.36175.

This diagonal prompted me to believe that the primary wave correction was over.

From 1,36175, price was expected to complete the last leg of the cycle wave correction in a move that should break above i.58619. The rally from 1.36175 was rather a correction ( double zigzag) and this changed my view that the primary corrective wave might not be over yet and I favour price reacting to the correction in a new impulse wave down to 1.265.

The first leg of this correction ended in a 5-wave impulse primary wave and it's also expected to correct in 3-waves of the same degree which I once forecast to end at 1.3250 before the diagonal that formed at 1.36175.

This diagonal prompted me to believe that the primary wave correction was over.

From 1,36175, price was expected to complete the last leg of the cycle wave correction in a move that should break above i.58619. The rally from 1.36175 was rather a correction ( double zigzag) and this changed my view that the primary corrective wave might not be over yet and I favour price reacting to the correction in a new impulse wave down to 1.265.

How Longer Will The Bull Rule UsdJpy?

Usdjpy broke 13 year high with a long term impulse primary wave which started from 75.045 in late 2011. The primary impulse is presently at an advance stage which could probably extend to 135-136.

I believed the dip from 126 would be the beginning of a primary correction in what was expected to be a motive wave but a double zigzag corrective pattern was formed instead which suggested to me that the primary bullish wave should still continue and the next long term price levels to watch out for are 135-136 (2002 high was at 135.798).

Follow the intraday analysis here

Tuesday, August 4, 2015

Eurusd About To Complete A Triangle

Amidst uncertainty concerning the greek bailout, the Euro which is perhaps destined for more dip does not yet look set for it. The rally from 1.045 can be said to be corrective. The questions are: what corrective pattern and when will it end to give way for the bears to take over in a move expected to break below the 1.045 mark.

I have for a long time forecast a double zigzag correction to 1.78-85 price level and price has not fulfilled it neither has it invalidated it.

Friday, July 31, 2015

GBPNZD UPDATE

Elliot wave theory shows how human psychology is reflected in the charts . It is a roadmap to how traders behave or respond to market events. This phenomenon is shown in clear patterns, corrections or trends.

The last update on Gbpnzd showed a comprehensive all-encompassing market analysis that described the possible direction and resting zones to watch out for. Read the analysis titled GbpNzd. There were four probable patterns that price was expected to form.

Sunday, July 26, 2015

Anyway!.....Cable Is Bearish

Elliot wave theory is the most complete technical tool to understand the position of price in the framework of the market.. It clearly tells us the degree of any trend and correction within a market structure; when they start and end and what to expect afterward.

UsdCad: The Journey So Far And What To Expect.

UsdCad was my favourite currency pair. I have traded almost all the patterns in between for a long time. It's count was so easy for me and at a glance, I saw what price was saying in every move and turn.

At the beginning of this year, I started with a bearish bias though with a long term bullish sentiment. The article was titled UsdCad Analysis for 2015. I forecast a rally in price to 1.35 and above, but after a dip to 1.0 region.

Below is an excerpt from the article.

"In the long term, this current impulsive move from 2011 is probably part of the ‘C’ leg of the projected zigzag corrective pattern. The ‘C’ leg should take us to 1.35xx and 1.46xx in the years to come, probably a period of 3-4 years"

Friday, July 24, 2015

How To Use The Stochastic Oscillator

A lesson from EWI's Jeffrey Kennedy

By Elliott Wave International

The stochastic oscillator is a technical tool that was popularized by George Lane. It is a momentum indicator based on the idea that in an uptrending market the close tends to be near the high of the price bar, and in a downtrending market the close tends to be near the low of the price bar.Watch an 11-minute lesson from Jeffrey Kennedy's Trader's Classroom to learn how you can use this popular indicator in your analysis and trading.

Get more trading lessons like this one, free, from Jeffrey Kennedy:

3 Lessons: Learn to Spot Trade Setups on Your Charts

In these three video lessons, Jeffrey Kennedy shows you how to look for trading opportunities in your charts. Kennedy, instructor for Elliott Wave International's popular Trader's Classroom service, reviews the 5 core Elliott wave patterns and then shows you how to combine technical methods to create a compelling forecast.Get your free lessons now >>

Already have a login? Get immediate access to these lessons >>

Thursday, July 23, 2015

Wednesday, July 22, 2015

Watch Out For EurUSd

The last update I did on this currency pair was titled How to trade the elliot wave pattern when I wrote about how to follow price actions using elliot wave analysis and trading clear patterns that price usually respond to.

Prior to that, there was an update titled Eurusd in a bearish net , which was immediately followed by a fast bearish move.

Tuesday, July 21, 2015

How To Exit A Trade With A Pattern.

AudJpy was one of the markets doomed for a sell off after an analysis, based on elliot wave theory, that Japanese Yen was expected to strenghten across board, which means that Yen pairs were expected to fall..

Yen Pairs fell sharply days after the forecast.

AudJpy's decline from 97.399 was expected to be in 5 waves trendy move.

Wave 3 of this impulsive move tend to be in progress after the completion of the first two waves.

Perfect Forecast of JP Morgan.The Power of Alternative.

On 8th June, I posted an analysis here titled JP Porgan as caught on elliot wave on how I expected JP Morgan stock price to move in time to come.

I had two scenerios. While I favoured the first, I kept an eye on the second. i wrote about the favoured analysis below.

Tripple Zigzag In EurGbp.

The analytical chart below shows the dip of EurGbp from 0.98 to 0.695; a dip of more than 2800 pips in a period of 5 and a half years.

Prior to this dip, there was an advance from 0.566 at the beginning of this millennium (2000); that was more than 8 years.

It is clear that price reversed from 0.98 and still going southward. Few questions that might cross our minds include the following:

1. Is the bearish dip a trend reversal or correction?

2. If it's a correction, where and how could it end?

UsdCad To Take A Rest?

On 31st May, there was analysis here titled Multi Face Analysis of the Usdcad.

After the analysis, I put a sell order.

I was so sure that I was selling after the completion of a long term flat formation on the weekly chart which was confirmed by the 5-wave impulsive move.

Price was expected to break below 1.90 in a motive mood.

Tuesday, July 14, 2015

Short Term Analysis of Cable.

After a long move downside over a long period of time, Cable finally reversed at 1.455 and we are getting close to know how the resultant bullish move could turn to play out.

Viewing the bullish move through elliot wave binoculars, it's clear that the long term bearish move might not have concluded. What the chart is showing us presently is that price is correcting.

Price behaviour using EWT. A case study on Yen

I have still not yet found any chart theory or technical methodology that can can be used as a market predictive tool like the elliot wave theory.

Elliot waves theory's ability to distinguish distinctly between a trend and correction is itself a tool which, if well used, builds confidence in a trader.

On 3rd June, I posted an analysis on Yen titled What the charts are saying about Yen.

Monday, July 13, 2015

I Love Diagonals....Euraud!

This trade was one of the case studies of 'trade the pattern and not the count'. I am a strict advocate of pattern trading.

What's my business opening a position when a pattern is not in place?

Pattern Trading on AudNzd

One of my favourite elliot wave patterns is a well formed 5-wave impulsive move.

A non-overlapping 5-wave decline or advance as discussed by elliot wave theory is my 'bread and butter'.

The chart above was posted when I saw this pattern emerging on AudNzd on 22nd June in the article titled Audnzd Update.

After the completion of this pattern, a correction was expected. It was not surprising as price dipped fast.

The fifth wave of this pattern also formed a 5-wave pattern which allowed me to put a sell entry at 1.1325 with stop loss of 120 pips.

It was a very sweet trade and I closed my position making 300pips as a correction is expected upside.

It was a perfect textbook pattern which doesn't happen all the time. It is a high probability trade, not a perfect one.

It is one of the three patterns I intend to share with the participants of my 6-weeks intensive online mentorship course.

Book a space today.

Cost: #10000 or $70

Call or send sms to me on +2348134820569 or mail me @ forexmaster05@yahoo.com

Note: Only serious and interested people should contact me.

If you reside in portharcourt and its environ, you can book a one-on-one training with me.

Another pattern that will be taught was seen on Euraud. It was another textbook pattern . Read it above.

Thursday, July 9, 2015

How To Trade Elliot Wave Patterns

Elliot wave theory has proved time and time again how effective it could be in determining market direction.

Not only does it have high confident trading patterns to watch out for in any time frame and any market, but does have the ability to forecast market movement.... every bit of it!.

From the super fast tick chart to monthly time frame chart, its effectiveness is superb.

Tuesday, June 23, 2015

Monday, June 22, 2015

Is Cadjpy ready to go down?

On 15th June, we forecast a real strength in Yen. Yen pairs were expected to start falling according to the analysis titled Yen is expected to strengthen acrross board.

After a while, UsdJpy started falling but the Cadyen moved within a range.

We have been watching cadjpy for some time . The completion of the recent medium term bullish move could mean the completion of the long term zig zag correction which started in february.

The chart below shows the intra day wave count. A break below 99.45 could mean the continuation of the bearishness that paused before february.

Audnzd Update

On 10th June, we did an analysis titled Audnzd preparing for a new bullish move. We were willing to take a buy trade at 1.0815 with final target at 1.127.

We did and price advanced very fast.

In the last analysis, we used the chart above which showed a systematic impulsive dip that started toward the end of 2010 and ended in march around 1.0 price level.

Price advanced immediately after the completion of the fifth wave in what was expected to be the first impulsive move of a major correction.

This move was expected to end at 1.2770 ( the present price level).

The recent bullish move is a typical motive wave and a pull back is expected as price should advance to 1.2 region.

The chart below shows the first impulsive move of the correction.

1.300 ( a strong resistance) and 1.1475 ( 100% projection of wave 1-3 from 4) are good levels of reversal.

Price is not expected to break above 1.1475 before the intraday bearish movement starts.

From the intraday chart below, we'll see that price could still move a bit upside, probably above 1.300 before turning to the south. 1.1475 should be held above.

Friday, June 19, 2015

Intra day Triangle in Eurusd

On 31st may, there was an analysis here titled Two Face Of Eurusd and I wrote about the two possible near term scenario.

I though, maintained a bullish bias but with a condition. The bullish set up was satisfied and price rallied, just as expected. I posted an update before that. Read HERE.

To end that post, I wrote

"It's expected to be impulsive, but a deep correction could emerge in double or triple zigzag correction which would force us to note that there could still be some move downside despite the general belief that Eurusd has bottomed on the long term"

With the pattern forming now, as shown in the diagram below, the recent bullish move is counting toward a double zig zag correction.

There has been some economic news surrounding this pair of late. many investors are on the sideline and price went into a congestion ( a triangle correction).

Price broke out of the triangle with a minimal momentum and further momentum is expected for Eurusd to rally to 1.175... psychological level where the correction could finally end for the resumption of the long term bearsih movement.

Tuesday, June 16, 2015

Gbpusd Intra day Update.

The market ended today with cable advancing further .

After taking a buy at 1.5350 with first real target at 1.5620 (270 pips), I decided to cash out as price is expected to correct to 1.5450.

The intra day wave analysis in the chart below shows that the first two days of this week have almost completed an ending diagonal terminating the impulsive wave 3 that started last week and price could dip but not below 1.5451 before further rally above 1.5650 and probably 1.5807.

If price dips below 1.5451, the bears will have taken the intra day bearish movement and we might see a dip to 1.5.

Monday, June 15, 2015

UsdJpy Intra day Update.

Earlier today, we posted of how our elliot wave analysis could mean a turn around for Yen pairs. After a very impressive bearish strenght of the Yen, we expect a reversal of trend or at least a retracement.

UsdJpy made a sharp turn around slightly below 126, typical of an impulsive move and now moving back in what looks like a corrective move.

We thought the correction will be shallow as it resisted around 124 (38.2-50% retracement of the intra day bearish move).

The market opened today with a gap down and since then, intra day price has adjusted and gone into a triangle congestion making room for a deeper correction upward to the region of 124.7.

If price breaks above the triangle upside, the next level to watch out for is 124.7

If price breaks to the south of the triangle, that means we will retain the shallow correction and ride down.

We don't expect price to break above 126 unless there is still room for more bullish move and if it happens, so be it.

We re-analyse and check the position of price in the long term view.

Yen Is Expected To Strenghten Across Board.

On 3rd June we had an analytical report titled What the Charts are saying about Yen. We saw how Yen has dipped for many years, from 2011 and making a 4 year low.

We made comparisons with other Yen pairs and forecast an imminent reversal in the event of things, but not until further movement up.

We forecast levels of reversal for UsdJpy, CadJpy, GbpJpy, AudJpy. Among all these pairs, we chose to look closely at UsdJpy and CadJpy

#UsdJpy

Price broke above the intraday triangle (intra day wave 4) to move in a clear 5-wave impulse to the upside.

The intraday wave structure is labelled below.

The wave intraday 5-wave perfectly fulfill all elliot wave rules and guidelines for an impulsive wave.

As expected, price crashed below the 4th wave and then retraced to 124 which is a good intra day resistance.

Price could crash further to 119 ( the low of the longer term 4th wave).

We took our sell order at 124 last week with stop loss slightly above 126 and our first ultimate target at 119.

We had the courage to take this trade because we percieved the Yen might start strenghtening across board and with a deeper bearish corrective bias on Usd Index.

#CadYen

After the completion of the triangle 4th wave, we took the ride up and exited at 101 for a profit of 170pips.

Price forming a rejection sign at a crucial resistance level. It might start falling from there as expected

Updates will come later.

Wednesday, June 10, 2015

AudNzd Preparing For A New Bullish Move?

From the weekly chart below, it's clear how this pair has dipped from year 2010. In a clear 5-wave impulsive move, price bottomed at almost 1.00 making Aussie at par with Nzd.

1.00 was a very strong psychology level and price , as expected, advanced in what look like a five wave impulsive bullish move of a lower degree.

The lower degree bullish move is expected to reach 1.127 which a strong resistance.

The pattern forming from the intra day chart below is a zigzag correction making the fourth wave of the bullish advance discussed above.

An intraday break above 1.0817 should trigger the bullish move and the near target should be 1.127 if 1.09 resistance is broken upside

Light Crude Oil To Resume The Downward Trend

'The trend is your friend'.

Everyone familiar with technical analysis would be very familiar with this statement.

Many traders believe that following the trend can be more profitable that going against it.

Using elliot wave theory, we are always trading in line with a major trend or a minor trend within a major trend.

The light crude has been falling since August 2013 in what seem to be an impulsive move. The rally from $43 is presenting a zigzag formation.

The zigzag is already completed labelled as the fourth wave.

Price is expected to head down.

It should break below 43.65 in another bearish impulsive movement to complete the long term bearish trend.

Tuesday, June 9, 2015

Natural Gas As It Stands.

The sell off from 5.74 in February 2014 till April 2015 can be explained in two ways by the elliot waves theory.

One labelled as a correction while the other as an impulsive move.

The wave count below shows that the dip from 5.74 is a mere correction and price is expected to rise in a new bullish impulsive move which could take few years to complete.

This move is expected to break above 5.74 resistance and go higher.

The push in April 2015 at 2.45 could be taken as a sub wave of the first wave of the prospective bullish impulsive move.

Price is expected to rally from the present level ( or after a little intraday further dip) to 3.7 if this count will hold.

The second wave count (below) posits that the natural gas dip is a developing impulsive move and the recent bullish move is the fourth wave correction.

The fourth wave appear shallow. Further rally is expected upside from the present price level to 3.53.

The two scenario forecast further move upside , one as a reversal and the other as a correction.

If price does rally further to 3.5 and breaks above it to 3.7,the second scenario will be invalid as the fourth wave will be trading in the region of wave 2 ( against elliot wave rule of impulse waves) and the first wave count will be the favourite.

On the other hand, if price rallies to 3.5 and bounces back to the south, the second wave count will be valid.

Right now, I expect price to continue the rally.

If price dips further to break 2.40 without advancing further, the counts will be re-done to re-analyse what price is speaking.

Dollar Index Preparing For A Deep Correction?

After a very long time, the dollar is finally testing the bearish side.

The long term advance that ended temporarily or permanently at 100.765 is appearing to favour the bearish side in what looks like a deep correction.

Double and triple zigzag corrective patterns form typical swings of higher highs/ higher lows for the bulls and lower highs/lower lows for the bears.

Price is expected to break below 93.06 (the last low) to form a lower low, and that would be a typical double zigzag. The dip is projected to get to 90.30.

This should affect Usd currency pairs especially the Eurusd which is presently forming the same pattern to the upside.

Price will prove everything right or wrong. Elliot waves theory helps to follow price and project possible turning points.

The labelled support and resistance levels in the chart below should be watched with keen interest.

Updates will come as price movement proceeds

Monday, June 8, 2015

EurAud Rally After The Diagonal

The charts above were used to analyse Euraud on 2nd June, titled Euraud at Critical Wave Zones.

We saw from the weekly chart that there was a divided thought on the decision to take a bullish conviction.

The correction was projected to complete at 1.3250 ( a good fibonacci and psychology level) but the formation of the ending diagonal posed an early completion and price is expected to rally further.

The intra day resisting region at 1.4350-4450 quickly came to mind.

We thought that a bounce from this region could invalidate the diagonal (since price will still be within its territory).

As price broke above this resisting region, the bullish move was activated.

With the strength of Euro across major currency pairs, Euraud might rise higher to break above 1.5341, 1.5829 and soar high.

Price will validate or invalidate this.

You can get updates here

EurUsd Bullish Scenerio Activated

The two charts above were used to forecast the movement of Eurusd on an article here titled The Two face of Eurusd.

Despite favouring the bullish move, we had an alternative.

One of the reasons why the elliot wave theory has been used by successful chartists over many decades.

There are always alternatives and you know when you are wrong.

It's flexible and allows prices to move the way they want and we can follow religiously.

Price broke out of the region in red and retraced exactly to it. The bullish journey is likely to happen.

The period origin of this bullish move was March 2015.

It's expected to be impulsive, but a deep correction could emerge in double or triple zigzag correction which would force us to note that there could still be some move downside despite the general belief that Eurusd has bottomed on the long term.

The new wave count goes as thus:

I expect further rally to 1.1800 and 1.2440 (deeper correction). Price will decide in a week or two where it will end in the nearest term.

Updates will be provided here.

JP Morgan as Caught on Elliot Wave

Prices are tending high in a non-overlapping impulsive trend. The recent rally which I labeled as the third wave of the impulsive move is ending in an expanding diagonal formation.

In expanding diagonal, wave 5 is greater than wave 3 which is greater that wave 1; wave 4 is greater than wave 2 and the connecting trendlines, upper and lower, show that prices should continue the rally to $70 where a minor dip to $65 region is very likely before a further rally to probably $72.

Alternatively, price could be forming a double zigzag formation which could have a reversal bearish impact. Price could fall below $58 and deeper in what could be an impulsive larger wave bearish move.

In the two wave count, price is expected to fall after, perhaps, further rally.

The extent of the fall will determine which count is valid. A minor dip to $65 follow by further rally will validate the first count while a break below $65 could validate the second count.

Subscribe to:

Posts (Atom)