Tuesday, June 23, 2015

Monday, June 22, 2015

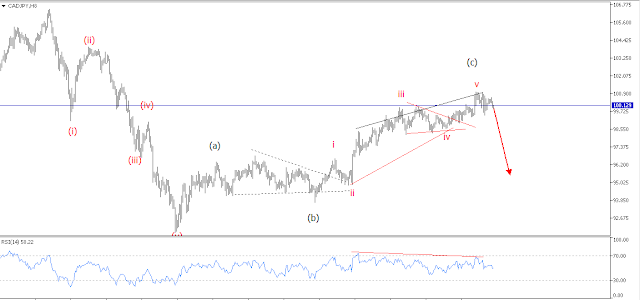

Is Cadjpy ready to go down?

On 15th June, we forecast a real strength in Yen. Yen pairs were expected to start falling according to the analysis titled Yen is expected to strengthen acrross board.

After a while, UsdJpy started falling but the Cadyen moved within a range.

We have been watching cadjpy for some time . The completion of the recent medium term bullish move could mean the completion of the long term zig zag correction which started in february.

The chart below shows the intra day wave count. A break below 99.45 could mean the continuation of the bearishness that paused before february.

Audnzd Update

On 10th June, we did an analysis titled Audnzd preparing for a new bullish move. We were willing to take a buy trade at 1.0815 with final target at 1.127.

We did and price advanced very fast.

In the last analysis, we used the chart above which showed a systematic impulsive dip that started toward the end of 2010 and ended in march around 1.0 price level.

Price advanced immediately after the completion of the fifth wave in what was expected to be the first impulsive move of a major correction.

This move was expected to end at 1.2770 ( the present price level).

The recent bullish move is a typical motive wave and a pull back is expected as price should advance to 1.2 region.

The chart below shows the first impulsive move of the correction.

1.300 ( a strong resistance) and 1.1475 ( 100% projection of wave 1-3 from 4) are good levels of reversal.

Price is not expected to break above 1.1475 before the intraday bearish movement starts.

From the intraday chart below, we'll see that price could still move a bit upside, probably above 1.300 before turning to the south. 1.1475 should be held above.

Friday, June 19, 2015

Intra day Triangle in Eurusd

On 31st may, there was an analysis here titled Two Face Of Eurusd and I wrote about the two possible near term scenario.

I though, maintained a bullish bias but with a condition. The bullish set up was satisfied and price rallied, just as expected. I posted an update before that. Read HERE.

To end that post, I wrote

"It's expected to be impulsive, but a deep correction could emerge in double or triple zigzag correction which would force us to note that there could still be some move downside despite the general belief that Eurusd has bottomed on the long term"

With the pattern forming now, as shown in the diagram below, the recent bullish move is counting toward a double zig zag correction.

There has been some economic news surrounding this pair of late. many investors are on the sideline and price went into a congestion ( a triangle correction).

Price broke out of the triangle with a minimal momentum and further momentum is expected for Eurusd to rally to 1.175... psychological level where the correction could finally end for the resumption of the long term bearsih movement.

Tuesday, June 16, 2015

Gbpusd Intra day Update.

The market ended today with cable advancing further .

After taking a buy at 1.5350 with first real target at 1.5620 (270 pips), I decided to cash out as price is expected to correct to 1.5450.

The intra day wave analysis in the chart below shows that the first two days of this week have almost completed an ending diagonal terminating the impulsive wave 3 that started last week and price could dip but not below 1.5451 before further rally above 1.5650 and probably 1.5807.

If price dips below 1.5451, the bears will have taken the intra day bearish movement and we might see a dip to 1.5.

Monday, June 15, 2015

UsdJpy Intra day Update.

Earlier today, we posted of how our elliot wave analysis could mean a turn around for Yen pairs. After a very impressive bearish strenght of the Yen, we expect a reversal of trend or at least a retracement.

UsdJpy made a sharp turn around slightly below 126, typical of an impulsive move and now moving back in what looks like a corrective move.

We thought the correction will be shallow as it resisted around 124 (38.2-50% retracement of the intra day bearish move).

The market opened today with a gap down and since then, intra day price has adjusted and gone into a triangle congestion making room for a deeper correction upward to the region of 124.7.

If price breaks above the triangle upside, the next level to watch out for is 124.7

If price breaks to the south of the triangle, that means we will retain the shallow correction and ride down.

We don't expect price to break above 126 unless there is still room for more bullish move and if it happens, so be it.

We re-analyse and check the position of price in the long term view.

Yen Is Expected To Strenghten Across Board.

On 3rd June we had an analytical report titled What the Charts are saying about Yen. We saw how Yen has dipped for many years, from 2011 and making a 4 year low.

We made comparisons with other Yen pairs and forecast an imminent reversal in the event of things, but not until further movement up.

We forecast levels of reversal for UsdJpy, CadJpy, GbpJpy, AudJpy. Among all these pairs, we chose to look closely at UsdJpy and CadJpy

#UsdJpy

Price broke above the intraday triangle (intra day wave 4) to move in a clear 5-wave impulse to the upside.

The intraday wave structure is labelled below.

The wave intraday 5-wave perfectly fulfill all elliot wave rules and guidelines for an impulsive wave.

As expected, price crashed below the 4th wave and then retraced to 124 which is a good intra day resistance.

Price could crash further to 119 ( the low of the longer term 4th wave).

We took our sell order at 124 last week with stop loss slightly above 126 and our first ultimate target at 119.

We had the courage to take this trade because we percieved the Yen might start strenghtening across board and with a deeper bearish corrective bias on Usd Index.

#CadYen

After the completion of the triangle 4th wave, we took the ride up and exited at 101 for a profit of 170pips.

Price forming a rejection sign at a crucial resistance level. It might start falling from there as expected

Updates will come later.

Wednesday, June 10, 2015

AudNzd Preparing For A New Bullish Move?

From the weekly chart below, it's clear how this pair has dipped from year 2010. In a clear 5-wave impulsive move, price bottomed at almost 1.00 making Aussie at par with Nzd.

1.00 was a very strong psychology level and price , as expected, advanced in what look like a five wave impulsive bullish move of a lower degree.

The lower degree bullish move is expected to reach 1.127 which a strong resistance.

The pattern forming from the intra day chart below is a zigzag correction making the fourth wave of the bullish advance discussed above.

An intraday break above 1.0817 should trigger the bullish move and the near target should be 1.127 if 1.09 resistance is broken upside

Light Crude Oil To Resume The Downward Trend

'The trend is your friend'.

Everyone familiar with technical analysis would be very familiar with this statement.

Many traders believe that following the trend can be more profitable that going against it.

Using elliot wave theory, we are always trading in line with a major trend or a minor trend within a major trend.

The light crude has been falling since August 2013 in what seem to be an impulsive move. The rally from $43 is presenting a zigzag formation.

The zigzag is already completed labelled as the fourth wave.

Price is expected to head down.

It should break below 43.65 in another bearish impulsive movement to complete the long term bearish trend.

Tuesday, June 9, 2015

Natural Gas As It Stands.

The sell off from 5.74 in February 2014 till April 2015 can be explained in two ways by the elliot waves theory.

One labelled as a correction while the other as an impulsive move.

The wave count below shows that the dip from 5.74 is a mere correction and price is expected to rise in a new bullish impulsive move which could take few years to complete.

This move is expected to break above 5.74 resistance and go higher.

The push in April 2015 at 2.45 could be taken as a sub wave of the first wave of the prospective bullish impulsive move.

Price is expected to rally from the present level ( or after a little intraday further dip) to 3.7 if this count will hold.

The second wave count (below) posits that the natural gas dip is a developing impulsive move and the recent bullish move is the fourth wave correction.

The fourth wave appear shallow. Further rally is expected upside from the present price level to 3.53.

The two scenario forecast further move upside , one as a reversal and the other as a correction.

If price does rally further to 3.5 and breaks above it to 3.7,the second scenario will be invalid as the fourth wave will be trading in the region of wave 2 ( against elliot wave rule of impulse waves) and the first wave count will be the favourite.

On the other hand, if price rallies to 3.5 and bounces back to the south, the second wave count will be valid.

Right now, I expect price to continue the rally.

If price dips further to break 2.40 without advancing further, the counts will be re-done to re-analyse what price is speaking.

Dollar Index Preparing For A Deep Correction?

After a very long time, the dollar is finally testing the bearish side.

The long term advance that ended temporarily or permanently at 100.765 is appearing to favour the bearish side in what looks like a deep correction.

Double and triple zigzag corrective patterns form typical swings of higher highs/ higher lows for the bulls and lower highs/lower lows for the bears.

Price is expected to break below 93.06 (the last low) to form a lower low, and that would be a typical double zigzag. The dip is projected to get to 90.30.

This should affect Usd currency pairs especially the Eurusd which is presently forming the same pattern to the upside.

Price will prove everything right or wrong. Elliot waves theory helps to follow price and project possible turning points.

The labelled support and resistance levels in the chart below should be watched with keen interest.

Updates will come as price movement proceeds

Monday, June 8, 2015

EurAud Rally After The Diagonal

The charts above were used to analyse Euraud on 2nd June, titled Euraud at Critical Wave Zones.

We saw from the weekly chart that there was a divided thought on the decision to take a bullish conviction.

The correction was projected to complete at 1.3250 ( a good fibonacci and psychology level) but the formation of the ending diagonal posed an early completion and price is expected to rally further.

The intra day resisting region at 1.4350-4450 quickly came to mind.

We thought that a bounce from this region could invalidate the diagonal (since price will still be within its territory).

As price broke above this resisting region, the bullish move was activated.

With the strength of Euro across major currency pairs, Euraud might rise higher to break above 1.5341, 1.5829 and soar high.

Price will validate or invalidate this.

You can get updates here

EurUsd Bullish Scenerio Activated

The two charts above were used to forecast the movement of Eurusd on an article here titled The Two face of Eurusd.

Despite favouring the bullish move, we had an alternative.

One of the reasons why the elliot wave theory has been used by successful chartists over many decades.

There are always alternatives and you know when you are wrong.

It's flexible and allows prices to move the way they want and we can follow religiously.

Price broke out of the region in red and retraced exactly to it. The bullish journey is likely to happen.

The period origin of this bullish move was March 2015.

It's expected to be impulsive, but a deep correction could emerge in double or triple zigzag correction which would force us to note that there could still be some move downside despite the general belief that Eurusd has bottomed on the long term.

The new wave count goes as thus:

I expect further rally to 1.1800 and 1.2440 (deeper correction). Price will decide in a week or two where it will end in the nearest term.

Updates will be provided here.

JP Morgan as Caught on Elliot Wave

Prices are tending high in a non-overlapping impulsive trend. The recent rally which I labeled as the third wave of the impulsive move is ending in an expanding diagonal formation.

In expanding diagonal, wave 5 is greater than wave 3 which is greater that wave 1; wave 4 is greater than wave 2 and the connecting trendlines, upper and lower, show that prices should continue the rally to $70 where a minor dip to $65 region is very likely before a further rally to probably $72.

Alternatively, price could be forming a double zigzag formation which could have a reversal bearish impact. Price could fall below $58 and deeper in what could be an impulsive larger wave bearish move.

In the two wave count, price is expected to fall after, perhaps, further rally.

The extent of the fall will determine which count is valid. A minor dip to $65 follow by further rally will validate the first count while a break below $65 could validate the second count.

Gold Spot On!...

The dip from 2011 on the long term is looking impulsive as price crashed down in style.

This dip goes well with the elliot wave theory which says, markets retrace in 3s in the opposite direction as the prevailing trend which is usually in 5s.

On the long term, the corrective 3s are coming as expected, though could be in different corrective pattern. The first of the 3 - corrective waves according to the elliot wave theory are expected to be motive i.e Impulse waves or diagonals.

The Gold market looks like being in the first phase of this correction and it's expected to be a motive....Impulsive is more likely based on what we see at the moment.

This impulsive move which started in 2011 has completed the fourth phase of its development with a triangle corrective pattern and a crash down is expected as the last phase should be a motive wave.

With Fibonacci extensions and projections, the dip could continue to 681 in few years’ time.

Price has, for couple of times, rejected 1126 thereby making it a psychological level to watch out for. A break below it could give the bears the upper hand.

The last phase of the expected bearish impulsive move started in January 2015 at 1309 and the corrective rally followed in March at 1141.

Presently, the corrective rally can be analysed in two ways. As an expanding triangle or a zigzag.

With the expanding triangle, price should rise to 1246 (a psychological level) before a new bearish intra day impulsive move would drive price below 1141 and probably deeper.

If the zigzag correction holds, price could rally to 1200 before it continues the bearish movement as the first bullish intraday correction might have ended at 1230 (the most recent high).

Subscribe to:

Posts (Atom)