Wednesday, December 23, 2015

Monday, December 21, 2015

Gold Rally Is Imminent: How Prepared Are You?

Since 2011, Gold has been on a free fall from $1920.5 per ounce and now, only been supported by a psychological $1000 price level.

I labelled the rise to $1920.5 a 5-wave impulse.

From a larger forecasting point of view, Gold might still fall in the future to $671.11 after an expected rally to $1450-1500 price levels. All these will be, if the correction from $1920.50 will be a deep or complex zigzag corrective pattern.

Of course, we can always adjust our analytical forecast as price determines evolving patterns.

Right now, what we see is a clear 5-wave fall from $1920.50 which is labelled as the first leg of the correction of the impulse wave that ended in September 2011.

The weekly chart below shows this clearly.

The second leg, a prospective 3-wave rally, is expected to end around $1450-1500 price levels.

More so, the fifth wave of the impulse dip from $1920.50 is a clear ending diagonal pattern which gives us more confidence as to the expected rally. This is shown in the daily chart below.

$1000, a psychology price level, is expected to hold as a support. A dip below it could hamper the price of Gold going up.

A break above $1100.35 should trigger a long trade as price is expected to break above $1193.7 and to $1300.46 in the medium term.

Send your request to Forexmaster05@yahoo.com

I labelled the rise to $1920.5 a 5-wave impulse.

From a larger forecasting point of view, Gold might still fall in the future to $671.11 after an expected rally to $1450-1500 price levels. All these will be, if the correction from $1920.50 will be a deep or complex zigzag corrective pattern.

Of course, we can always adjust our analytical forecast as price determines evolving patterns.

Right now, what we see is a clear 5-wave fall from $1920.50 which is labelled as the first leg of the correction of the impulse wave that ended in September 2011.

The weekly chart below shows this clearly.

The second leg, a prospective 3-wave rally, is expected to end around $1450-1500 price levels.

More so, the fifth wave of the impulse dip from $1920.50 is a clear ending diagonal pattern which gives us more confidence as to the expected rally. This is shown in the daily chart below.

$1000, a psychology price level, is expected to hold as a support. A dip below it could hamper the price of Gold going up.

A break above $1100.35 should trigger a long trade as price is expected to break above $1193.7 and to $1300.46 in the medium term.

Let's alert you of high confidence trade set ups. Join a group of happy traders who have been receiving our trade signals both free and premium. We made over 2000pips last month.

Wednesday, December 16, 2015

Audnzd: What We Expect Next

As a technical analyst, it's essential to learn different technical approaches to market prices.

Elliot wave theory, chart pattern analysis, fibonacci harmonic analysis, candlestick price action are some of the effective elements of technical armory every chartist must equip himself with.

On October 29th, an analysis was posted here on Audnzd titled Audnzd: Upward trend to continue?. We discussed about a 5-wave bearish elliot wave impulse pattern as seen on the weekly chart.

After the end of the impulsive wave, a 3-wave correction , as expected, seems to have started as price rallied from 2015 low.

We narrowed down our elliot wave count to the hourly chart as we got a bullish trade set-up which we quickly shared with our subscribers.

All our profit targets were hit; though we were forced to close some of our trade before the final target due to a bearish reversal warning in the article titled: Audnzd: A Technical Combination.

Price rallied further, hit all targets and started falling as expected.

Will this fall continue or price will resume the rally?

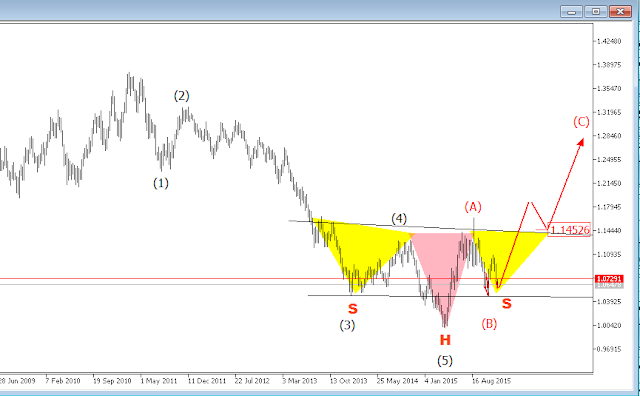

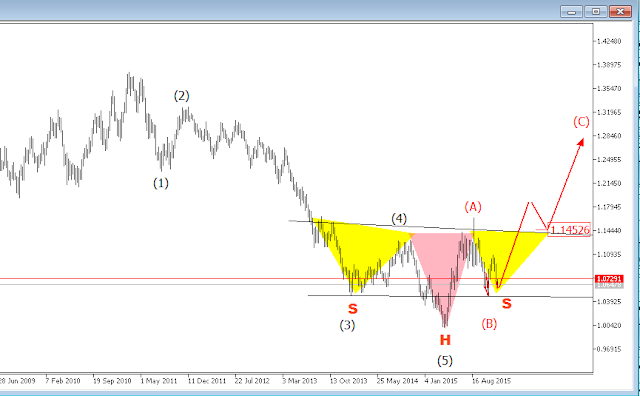

The chart below is the recent weekly chart.

There is a prospective inverted head and shoulder reversal chart pattern subsumed in what could be a complete elliot wave cycle.

A complete elliot wave cycle is a 5-wave impulse trend wave followed by a 3-wave correction in the opposite direction of the trend.

With our wave count, we presume that price is still in the wave-C of the correction expected and the second wave of the C-wave is expected to end soon.

The 2nd wave of wave-C is a hourly tripple zigzag corrective pattern supported by a confluence zone.

If price is contained above 1.05 and rallied to break above 1.077, we will be prepared to get in line with a long position aiming 1.1548 as the final future price level.

Join us as we ride the trend together.

Our free signal service started last month with a 100% wins on 5 trades profiting about 2000pips.

You can take control of your trades and funds with our analysis and signals as an aggressive or conservative trader.

Send your E-mail address and phone number to forexmaster05@yahoo.com

Elliot wave theory, chart pattern analysis, fibonacci harmonic analysis, candlestick price action are some of the effective elements of technical armory every chartist must equip himself with.

On October 29th, an analysis was posted here on Audnzd titled Audnzd: Upward trend to continue?. We discussed about a 5-wave bearish elliot wave impulse pattern as seen on the weekly chart.

After the end of the impulsive wave, a 3-wave correction , as expected, seems to have started as price rallied from 2015 low.

We narrowed down our elliot wave count to the hourly chart as we got a bullish trade set-up which we quickly shared with our subscribers.

All our profit targets were hit; though we were forced to close some of our trade before the final target due to a bearish reversal warning in the article titled: Audnzd: A Technical Combination.

Price rallied further, hit all targets and started falling as expected.

Will this fall continue or price will resume the rally?

The chart below is the recent weekly chart.

There is a prospective inverted head and shoulder reversal chart pattern subsumed in what could be a complete elliot wave cycle.

A complete elliot wave cycle is a 5-wave impulse trend wave followed by a 3-wave correction in the opposite direction of the trend.

With our wave count, we presume that price is still in the wave-C of the correction expected and the second wave of the C-wave is expected to end soon.

The 2nd wave of wave-C is a hourly tripple zigzag corrective pattern supported by a confluence zone.

If price is contained above 1.05 and rallied to break above 1.077, we will be prepared to get in line with a long position aiming 1.1548 as the final future price level.

Join us as we ride the trend together.

Our free signal service started last month with a 100% wins on 5 trades profiting about 2000pips.

You can take control of your trades and funds with our analysis and signals as an aggressive or conservative trader.

Send your E-mail address and phone number to forexmaster05@yahoo.com

Wednesday, December 2, 2015

AudJpy May Continue Downside

We have been watching the long term historical activities of this pair for some time now but waiting for the right moment to follow the bearish trend move.

The move from 55.23 (in year 2000) to 108.275 ( in year 2007) was a clear 5-wave impulse (as illustrated in the chart below).

After such a move, one would expect a 3-wave correction (according to elliot wave theory). The corrections, though varying and complex in nature, are easy to spot.

The good thing about trading the elliot wave theory is that short term opportunities can be spotted within a large time frame and still following all the rules and guidelines of the wave theory. One can forecast a long term market move and trade clear patterns in the direction of the trend.

From 108.275 to 54.91 wave w ( a 3-wave decline) and back to wave x at 105.4 (a 3-wave rally), one can anticipate a double zigzag decline in labelled (W,X,Y in blue) which could end at 55 price level or below.

How can we take advantage of this forecast?, we can go to a lower time frame and read wave theory and price activities using combinations of technical tools.

The decline from 103.46 has completed the first leg of a double zigzag pattern and now correcting to 91.2 region. We expect price to be contained below 91.27 below the falling trendline. There is so much fibonacci ratios converging in that region. We expect it to be strong enough to keep the correction exhausted.

If there is a short opportunity below 91.27, a good ride could happen as we follow price decline further to 71.86

Let's alert you of any trading opportunity we spot.

You can send your E-mail address to Forexmaster05@yahoo.com for high probability forex signals.

The move from 55.23 (in year 2000) to 108.275 ( in year 2007) was a clear 5-wave impulse (as illustrated in the chart below).

After such a move, one would expect a 3-wave correction (according to elliot wave theory). The corrections, though varying and complex in nature, are easy to spot.

The good thing about trading the elliot wave theory is that short term opportunities can be spotted within a large time frame and still following all the rules and guidelines of the wave theory. One can forecast a long term market move and trade clear patterns in the direction of the trend.

From 108.275 to 54.91 wave w ( a 3-wave decline) and back to wave x at 105.4 (a 3-wave rally), one can anticipate a double zigzag decline in labelled (W,X,Y in blue) which could end at 55 price level or below.

How can we take advantage of this forecast?, we can go to a lower time frame and read wave theory and price activities using combinations of technical tools.

The decline from 103.46 has completed the first leg of a double zigzag pattern and now correcting to 91.2 region. We expect price to be contained below 91.27 below the falling trendline. There is so much fibonacci ratios converging in that region. We expect it to be strong enough to keep the correction exhausted.

If there is a short opportunity below 91.27, a good ride could happen as we follow price decline further to 71.86

Let's alert you of any trading opportunity we spot.

You can send your E-mail address to Forexmaster05@yahoo.com for high probability forex signals.

Subscribe to:

Posts (Atom)