Friday, October 31, 2014

Wednesday, October 29, 2014

Cadchf Escape Route

Trade management is one of the essentials of profitable trading. This is an art that has been mastered by the masters in the business of speculation, trading and forecasting of financial instrument.

A profitable traders gets along with the trade and take quality unbiased and unemotional decisions along the way.

I posted an analysis of cadchf yesterday, 28th October, when I forecast the long term and short term of this currency pair. You can read the analysis again.

I opted for a short position and presently price has consolidated upward since then. Well I have my trade management in place. I deem it fit to post here because someone could have taken the same decision.

Am I getting out of the short position? NO!.

The bears still have a good chance; the recent bullish triangle formed on the intra day charts could just be the second wave of the expected 5-wave impulsive move downside to complete the B leg of the probable zigzag correction I discussed yesterday and this will hold if price does not break above the first wave.

I expect price to dip from the current level to the zones I highlighted.

Conversely, if price broke the triangle upside, I may exit my short position as market could be on its way to form an intraday impulsive move downside according to the chart below

More update to come later as price show us where it's heading to.

I maintain a bearish short term bias and a bullish long term bias until price proves me wrong.

You can connect with me, check my contact

Tuesday, October 28, 2014

My Binoculars on CadChf over the long and short term

Since last month, I have been having a bearish short term view on the Cadchf and I was not surprised when a major dip ( on short term basis) started on 10th of October . This dip corrected and it seems the correction is over for the bearish short term dip to continue.

In order to know what to expect from this currency pair for a long term, I had to dig deeper and see farther. .....And yes, I've found something. Let me share with you.

Looking at the weekly chart, the last motive wave move probably ended on November 2007 and a bearish correction had surfaced since then. With a zigzag corrective pattern which probably could have ended on August 2011 and will be more probable if price breaks the upper boundary of the corrective channel in an Impulsive move to resume the bullish move for many years, perhaps a decade.

The long term bias will be bullish if these conditions are satisfied.

Price also could opt for a further dip, probably forming a complex correction or a new motive move ( I will come up with the analysis of this possibility later). These are long term views which will guide us as we follow price movement to the future having the information right at hand.

On the 4 H chart, there was a 5-wave impulsive move which ended successfully with an ending diagonal formation, little wonder price crashed in a characteristic ending diagonal resultant move.

The present bullish move is a correction which looked completed and I expect price to trade in the zone of (0.8200 and 0.8000) which are 100% and 161.8% extension of wave a from b respectively ; these target zones are also good support levels.

I'm presently in a short position as I watch how price play out and trust me to always update you.

You can forward your E-mail address to forexmaster05@yahoo.com or contact me for any question or partnership deal

Thursday, October 23, 2014

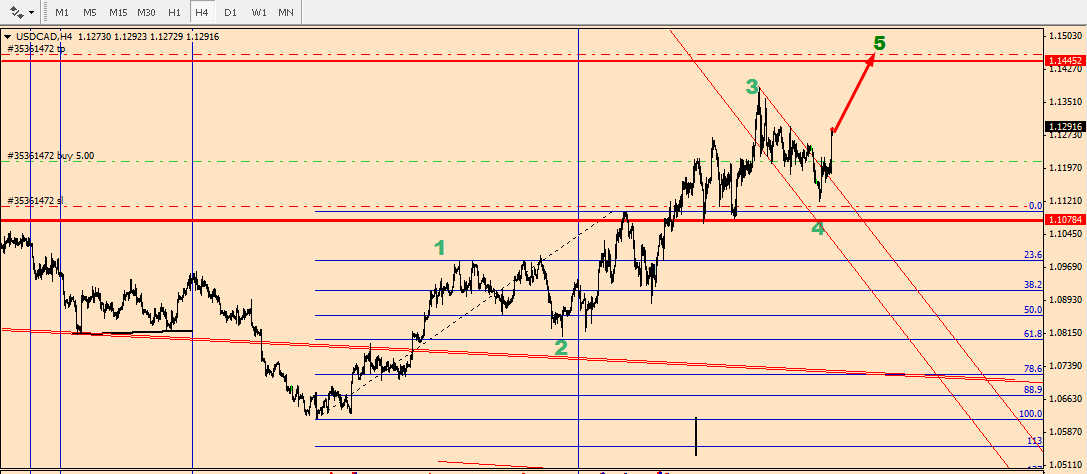

Two Face of Usdcad

Usdcad has proven to be a very predictable market in terms of technical analysis in the last few months. I have been able to gather close to 400 pips this month alone.

I predicted a bearish correction in my last post read the post here, with half of my trade closed at 100 pips ( risking 80 pips) and the other half to ride the trend with the stop loss adjusted to break even.

After days of waiting for the price to show where next it's heading to, I had to come with a two-face plan...A bullish-bearish scenario.

This market is presently in two scenarios and i will take time to discuss the two

Starting with the bearish scenario . I see an end of wave 3 of an expected 5-wave bullish move which could take us to 1.2000 and beyond. I expect a further dip in price in a corrective mode ( which is what is happening presently) along the wave 4 channel to 1.1100 before the bull move will surface once more.

I am presently in a bear trade as i stated above and I will remain there until the wave 4 channel is broken upside.

I will watch closely and get the picture price is painting before any further actions.

If price breakes the wave 4 channel in the picture above ( Ist scenario), I have a new wave count to analyse what price could be showing.

The recent bearish correction to end sub-wave 3 of wave 3 ( In green) started at the 161.8% extension of sub-wave 1 from sub-wave 2 ( in black) .

Presently, with the current correction pattern, price could be said to be forming a zigzag at 38.2% retracement of sub-wave 3 ( in black).

If price breaches the sub-wave 4 trenline up, this scenerio could be very valid as price will rally to the top of the wave 3 channel ( indicated by the broken lines channel) at 1.140 and 1.1550 ( 200% ext. of sub-wave 1 from sub-wave 2).

At this level wave 5 should be formed and market will be preparing for a major correction southward.

These are two very possible moves price can make in the nearest future.

Our responsibility is to wait till the market connect to us.

I will post an update here.

You can send your e-mail address to forexmaster05@yahoo.com to add you to my mailing list

Tuesday, October 21, 2014

(Video) How to Apply Moving Averages as a Trading Tool

By Elliott Wave International

A moving average (MA) is one of the simplest technical tools an analyst or trader can use. The most common one is the simple moving average (SMA). A 200-period SMA often determines trend, support and resistance. Dual moving averages, which are popular, are the basis of many trading systems.In this 6-minute video lesson, Elliott Wave International's Jeffrey Kennedy explores different types of moving averages and how you can apply single, dual and multiple moving averages on your charts.

If you enjoy this lesson, learn how you can download Jeffrey's 10-page eBook, How to Trade the Highest Probability Opportunities: Moving Averages.

How to Trade the Highest Probability Opportunities: Moving AveragesMoving averages are one of the most widely-used methods of technical analysis because they are simple to use, and they work. Now you can learn how to apply them to your trading and investing in this free 10-page eBook. Learn step-by-step how moving averages can help you find high-probability trading opportunities.Improve your trading and investing with Moving Averages! Download Your Free eBook Now >> |

Want to Know the REAL Reason Why the Stock Market Turned Down?

The rout in stocks is no "jinx"

By Elliott Wave International

In case you've been roving Mars for the past month, you've missed quite a fiasco from the world's leading stock market:"Since it topped out last month, the Dow has suffered eight triple digit losses� Add it all up, and the Dow has slid about 7.5% percent from its peak, the biggest retreat in more than two years. It also means the Dow has now given back all of its gains for the year -- and then some." (Daily Finance Oct. 15)Now, according to the mainstream experts, there are 3 key causes for the market's sell-off:

(1) Alibaba

On September 19, China's e-commerce behemoth Alibaba Group launched its $25 billion initial public offering on the New York Stock Exchange -- the largest I.P.O. ever in the history of all things, everywhere. An October 13 Bloomberg article calls the BABA reveal a giant, panda-sized sell signal and writes:

"The abundance of investor confidence needed to get Alibaba's record $25 billion initial public offering off the ground was but one of several red flags that made the market feel top heavy."This logic sounds legit now. But back when Alibaba was going to market, the only red flag was the one taunting the wild bulls to charge. From the September 25 USA Today:

"Calling a top based on a big I.P.O. is probably the weakest argument the bears have made so far... While the market isn't cheap, corporate earnings are still growing solidly, which should keep the bull alive."The next reason for the market's sell-off is...

(2) Ebola

"A much bigger issue confronting the market is the spread of the Ebola virus. This is by definition, a situation with an unquantifiable outcome and that it would create market uncertainty should hardly be surprising." (October 13 Bloomberg)Again, this explanation doesn't make sense, considering the fact that the Ebola crisis has been front and center in the news since the first outbreak was reported seven months ago -- on March 19, 2014. The first 3 American victims of the virus were flown into the United States from Liberia in early August, to receive treatment at the Centers for Disease Control in Atlanta, Georgia.

The third and final impetus for the market's insidious rout is...

(3) Voodoo Black Magic

Well, sort of. With no tangible trigger for the market's sell-off, an October 15 news source sites an intangible one:

"It's not unusual for the market to swing wildly in October... in what's become known as the 'Jinx Month.'" (Daily Finance)Jinx, as in coming from the Greek word "iynx," bird used in black magic.

At the end of the day, every single one of these efforts to explain the stock market rout occur after the fact -- AFTER the Dow has already plummeted over 1000 points from its September 19 peak.

Prior to the market losing its footing, Elliott Wave International published an urgent Elliott Wave Theorist Interim Report. The date of publication: September 19, the day of the high. The report warned investors that the Dow had very good reason to kiss its all-time high goodbye:

"Our daily closing Dow projection of 17,280 was achieved today."

"Our Flash service is short all three stock indexes."

"Next week, the U.S. stock averages should decline."

Reason for reversal # 1:

"It's now been one full year since October 9, 2013, the date that the Dow's fifth-wave ending diagonal [Elliott wave pattern] started."

An Elliott wave ending diagonal pattern is a 5-wave move usually occurring in wave 5. In all cases:

- They are found at the termination of larger patterns

- The indicate exhaustion of the larger movement

- They are followed by a dramatic reversal

"October 9, 2013 marks the start of the trendline that would eventually form the baseline of the diagonal, as shown on the daily chart. The market is signaling that this line is valid and important, as there have been six separate touch points over the past year.The next chart shows you how the Dow did, indeed, fall below this very important trendline as Short Term Update forecast:

"We've often said that trendlines are a meaningful facet of market analysis because we don't draw them, the market does. All we do is connect the points on the charts to show what the market thinks is significant.

"Today, for the first time in a year, the Dow closed below the trendline, providing another key piece of technical evidence that the wave structure of the prior advance is complete."

Fundamental analysis cites Alibaba, Ebola, and/or a magic "Jinx" as the cause(s) for the market sell-off -- after the fact.Moving forward, the choice of how you protect your financial future is yours.

-- VERSUS --Elliott wave analysis cited an important Fibonacci price target, a mature Elliott wave pattern, and a meaningful trendline as the causes -- in advance.

Read Our Newest Free Report: "This Is It"It's times like these when investors like you need to maintain a focus on the coming bear market that will take far too many by surprise. As Bob Prechter says, "bear markets move fast and are intensely emotional; investors and traders who are prepared have greater opportunities on the downside than on the upside."In this new report, you'll read some of the recent analysis Bob Prechter and Chief Market Analyst Steve Hochberg wrote before the late-September turn -- and some of what they have written since then. Download this free investor report and prepare your portfolio now >> |

Wednesday, October 15, 2014

Usdcad bearish correction on the book.

Usdcad will not stop spinning pips for me..Will it?. After another 160 pips cashed all out, this pair is is inviting for another ride....bearish ride!.

In my last post, where i traded the end of wave 4 at the break of the channel to ride up. I projected a level for end of wave 5 which has been penetrated and market is moving back very fast.

What I am expecting now is a bearish correction before the bullish run will continue.

The problem now is that, I am late for this market and I will wait for a retracement after today's daily candle formation.

I will be expecting price at 1.100 which will be my target in some days or few weeks. Patience is the key, isn't it?

More updates coming soon.

Let me add you to my mailing list, you can drop your e-mail address at the comment box or send to forexmaster05@yahoo.com

Tuesday, October 14, 2014

(Video) How -- and Why -- the Markets Fool Investors

Bob Prechter explores price action in crude oil to deliver an important investment lesson

By Elliott Wave International

Editor's note:

The following is a timeless clip from Robert Prechter's presentation as the Social Mood Conference on April 5, 2014.

Bob explores price action in crude oil to deliver an important investment lesson for all of us.

This video is a prime example for how the Wave Principle can help you prepare for moves in markets of all kinds that conventional analysis misses completely. To learn more about Elliott Wave Analysis, see the link below to three free videos from Elliott Wave International, the world's largest independent financial forecasting firm.

Learn the Why, What and How of Elliott Wave Analysis The Elliott Wave Crash Course is a series of three FREE videos that demolishes the widely held notion that news drives the markets. Each video will provide a basis for using Elliott wave analysis in your own trading and investing decisions. |

This article was syndicated by Elliott Wave International and was originally published under the headline (Video) How -- and Why -- the Markets Fool Investors. EWI is the world's largest market forecasting firm. Its staff of full-time analysts led by Chartered Market Technician Robert Prechter provides 24-hour-a-day market analysis to institutional and private investors around the world.

How to Find Trading Opportunities in ANY Market: Fibonacci Analysis

In this article, Elliott Wave International's Jeffrey Kennedy demonstrates ways to spot trading opportunities across any market and timeframe.

By Elliott Wave International

Elliott Wave International's Senior Analyst Jeffrey Kennedy is the editor of our Elliott Wave Trader's Classroom and one of our most popular instructors. Jeffrey's primary analytical method is the Elliott Wave Principle, but he also uses several other technical tools to supplement his analysis.

You can apply these methods across any market and any time frame.

Learn how you can get a free 14-page Fibonacci eBook at the end of this lesson.

The primary Fibonacci ratios that I use in identifying wave retracements are .236, .382, .500, .618 and .786. Some of you might say that .500 and .786 are not Fibonacci ratios; well, it's all in the math. If you divide the second month of Leonardo's rabbit example by the third month, the answer is .500, 1 divided by 2; .786 is simply the square root of .618.

There are many different Fibonacci ratios used to determine retracement levels. The most common are .382 and .618.

The accompanying charts also demonstrate the relevance of .236, .382, .500 .618 and .786. It's worth noting that Fibonacci retracements can be used on any time frame to identify potential reversal points. An important aspect to remember is that a Fibonacci retracement of a previous wave on a weekly chart is more significant than what you would find on a 60-minute chart.

With five chances, there are not many things I couldn't accomplish. Likewise, with five retracement levels, there won't be many pullbacks that I'll miss. So how do you use Fibonacci retracements in the real world, when you're trading? Do you buy or sell a .382 retracement or wait for a test of the .618 level, only to realize that prices reversed at the .500 level?

The Elliott Wave Principle provides us with a framework that allows us to focus on certain levels at certain times. For example, the most common retracements for waves two, B and X are .500 or .618 of the previous wave. Wave four typically ends at or near a .382 retracement of the prior third wave that it is correcting.

In addition to the above guidelines, I have come up with a few of my own over the past 10 years.

The first is that the best third waves originate from deep second waves. In the wave two position, I like to see a test of the .618 retracement of wave one or even .786. Chances are that a shallower wave two is actually a B or an X wave. In the fourth-wave position, I find the most common Fibonacci retracements to be .382 or .500. On occasion, you will see wave four retrace .618 of wave three. However, when this occurs, it is often sharp and quickly reversed.

My rule of thumb for fourth waves is that whatever is done in price, won't be done in time. What I mean by this is that if wave four is time-consuming, the relevant Fibonacci retracement is usually shallow, .236 or .382. For example, in a contracting triangle where prices seem to chop around forever, wave e of the pattern will end at or near a .236 or .382 retracement of wave three. When wave four is proportional in time to the first three waves, I find the .500 retracement significant. A fourth wave that consumes less time than wave two will often test the .618 retracement of wave three and suggests that more players are entering the market, as evidenced by the price volatility. And finally, in a fast market, like a "third of a third wave," you'll find that retracements are shallow, .236 or .382.

In closing, there are two things I would like to mention. First, in each of the accompanying examples, you'll notice that retracement levels repeat. Within the decline from the high in July Sugar (first chart), each countertrend move was a .618 retracement of the previous wave. The second chart demonstrates the same tendency with the .786 retracement. This event is common and is caused by the fractal nature of the markets.

Second, Fibonacci retracements identify high probability targets for the termination of a wave; they do not represent an absolute must-hold level. So when using Fibonacci retracements, don't be surprised to see prices reverse a few ticks above or below a Fibonacci target. This occurs because other traders are viewing the same levels and trade accordingly. Fibonacci retracements help to focus your attention on a specific price level at a specific time; how prices react at that point determines the significance of the level.

Learn How You Can Use Fibonacci to Improve Your TradingIf you'd like to learn more about Fibonacci and how to apply it to your trading strategy, download the free 14-page eBook, How You Can Use Fibonacci to Improve Your Trading. EWI Senior Tutorial Instructor Wayne Gorman explains:

See how easy it is to use Fibonacci in your trading. Download your free eBook today >> |

This article was syndicated by Elliott Wave International and was originally published under the headline How to Find Trading Opportunities in ANY Market: Fibonacci Analysis. EWI is the world's largest market forecasting firm. Its staff of full-time analysts led by Chartered Market Technician Robert Prechter provides 24-hour-a-day market analysis to institutional and private investors around the world.

Gbpchf Update.

12th October, I forecast a bullish move of this pair ( Read the full gist).

I expected price to break above the wave 4 channel before putting a long postion.

Despite the triple pin bars on the daily, Gbpchf dipped further and penetrated the support zone I highlighted. My entry level wasn't satisfied, so i stayed out and watched the fast dip.

I still keep my bullish bias intact and I expect price to price to react at 61.8% and 78.6% correction of the previous bullish trend.

Presently, price is returning to the corrective channel after a brief sharp movement below it and it's resting on a very strong intra day support zone. The correction has now dipped to 61.8% retracement, a good reversal fib-ratio.

I will put a long order if price rallies above the support zone to form a nice swing low especilally with a bullish engulfing candle. If this is formed, we would see a nice pin bar on the daily chart.

If price continues the dip, I will watch for reaction at 78.6-88.9 % ( here, price will complete a bat harmonic pattern).

Always check regularly for an update or forward your E-mail to forexmaster05@yahoo.com to alert you of new posts.

Sunday, October 12, 2014

Bullish move continuation on Gbpchf

On 2nd October, I pointed to an ending diagonal which signaled a bearish correction and I was not surprised that price moved just as anticipated.

I also pointed to the fact that I have a bullish bias. I expect price, after the completion of the present zigzag correction, to rally and break the top of the ending diagonal to complete the impulsive move.

This projected bullish move is also made tradable by a three daily pin bar drives resting on the near term support zone, the stochastic momentum on D1 and a divergence on the H4 chart.

When we have a clear recognizable pattern with other technical parameters aligned, we can trade with more confidence.

I will expect price to break above the falling wave 4 channel on H4 before buying.

Conversely, if price breaks below the support zone mentioned in high momentum, new analysis has to be done to be sure of what price is playing out

Let me add you to my mailing list.

Mail me @ forexmaster05@yahoo.com

Whatsapp: 2348134820569

Twitter: @Forexelyte

Friday, October 10, 2014

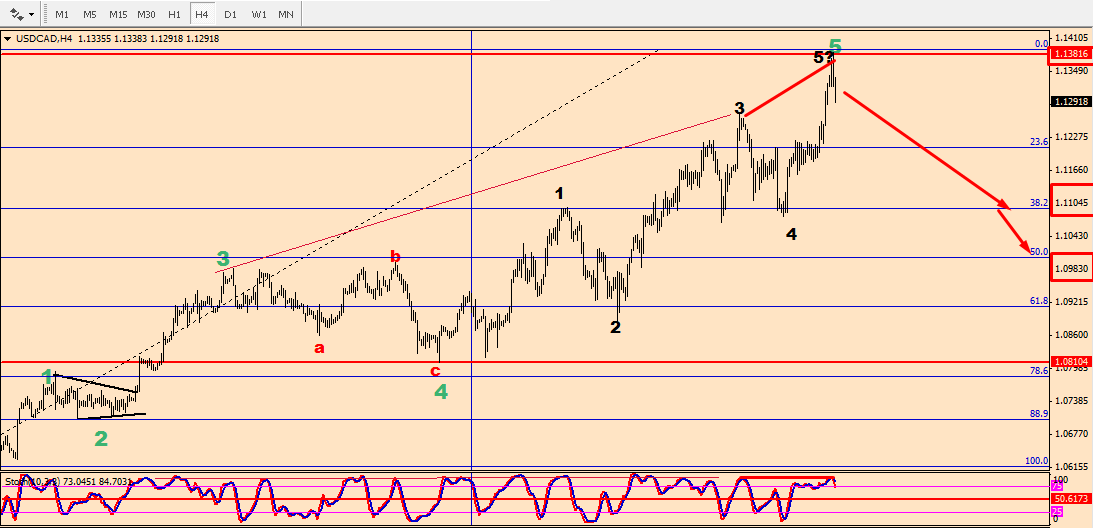

Is Usdcad prepared to resume the Uptrend?

I have been able to follow this pair nicely since July 6 when I predicted a powerful long term bullish move. Price was resting on the bear sides along the way and , each time it did, never failed to resume the bullish move.

Recently, on 5th october, I predicted a medium term correction after a perceived overbought. Price reacted as well and went down considerably with good profit (already closed 80% of my position).

You can take your time to read all my posts on Usdcad from July 6 to understand what I am talking about.

As we know, that a good trader or speculator doesn't stick to his thought about the movement of the market. He rather is flexible and adjust as price unfolds more information, and he reacts accordingly. He is less proactive and more reactive to price information. He reacts to what is happening and not what could happen.

A vivid look on this pair showed me that the recent bearish move we saw in Usdcad is a zigzag correction and price could resume the fifth wave to complete the 3rd wave of the larger uptrend.

Let me start with the weekly chart

What we are having is a motion and uncompleted wave 5. By projection, it should end at the zone painted blue which is a confluence of equality ratio(wave 1 = wave 5) and 61.8% retracement of the last bearish trend. Price could be on its way to fulfill this projection

Going by the 4H chart, a break above the wave 4 upper channel combined with a good bullish momentum should push price to 1.1364 which will be my first target if I decide to buy.

On the other hand, if price is held there and turn down I could be on my way to reach my final target on the bearish note before thinking bullish.

Wednesday, October 8, 2014

Usdcad Intra day Update

On 5th October, I talked about an end of wave 5 on the 4H chart of this pair for a bearish move ( Read Here) .

Price started reacting immediately to the bearish call and I cashed out 100pips on 50% of my position.

The bearish move has paused and entered a consolidation ( triangle) which if broken downward will give a nice ride.

The bears still have the chance especially from the 1H intraday chart which shows how price is reacting to the expected retracement ( 50% or 61.8%) of the wave 5.

If Usdcad breaks the triangle downside, it's either we have a wave 3 or c which could end at 1.1000 ( 161.8 % extension of a from b and 61.8% retracement of the wave 5 that I discussed on 5th October

If price breaks above the upper boundary of the traingle, I might look forward to exit the other 50% of my position.

I will keep an update as the market unfolds.

Tuesday, October 7, 2014

A New Look at Gold

On October 2, I was wondering if Gold was going to have a free ride down after breaking out of a triangle corrective pattern formed on W1 and another triangle on the intra day broken out after the US non farm payroll report (Read the story here).

I was expecting a pull back and then a bearish candlestick engulfing, but price went back to the triangle it once broken, giving me a reason to re-analyse.

After spending some time, I saw price bringing out a new picture- a bullish picture!

With a new look at the weekly chart, I saw that price is bouncing off the support line of the triangle after it formed the fourth (a-b-c) zigzag wave to resume a resume the last (a-b-c) corrective move ( triangles move in five corrective wave before completion) which should move close to the upper line of the W1 triangle.

With divergence and momentum oversold at this region, it could well be a good thought- we have a chance.

On the daily chart, I see a completion of a 5-wave impulsive move that completed the fourth wave I mentioned above clearly: and with divergence,channel support and momentum oversold, the bulls are preparing to take the golden initiative

If the bulls are taking over, I will expecting a (5-3-5) upward move to the roof of the W1 chart.

As price adds more, we get its intention more clearly.

I'm here to update you, so don't be far

Let me add you to my mailing list.

Send your E-mail address to Forexmaster05@yahoo.com

Whatsapp: 2348134820569

Follow on Twitter @ Forexelyte

Monday, October 6, 2014

UsdCad Is Overbought

Nothing interests me in this market more than seeing a pattern I recognise. On 6th July ,I speculated a long term upward move of this pair ( Read Here ) .

The bullish move that started on the aforementioned date is looking set to complete a nice impulsive 5 non-overlapping waves on the H4 time frame and I'm expecting a dip before price continues the long term bullish trend.

Presently, price has hit a strong resistance at 1.1275 with overbought and divergence signals on Macd and Stochastic respectively, it's not bad to think bearish, at least for intra-day moves.

I still maintain a general bullish bias but the bears could take a shot which could be profitable. Targets are 1.1025 ( 38.2 % retracement) and 1.0950 ( 50% retracement)

I will wait for a candlestick bearish reversal formation before embarking on the journey.

Conversely, if price broke 1.1275 in high momentum, then the impulsive move is not yet completed and more price candles will help to verify the next action.

Updates to come. Don't be far

Twitter: ForexelyteFacebook: Sanmi Adeagbo

E-mail: Forexmaster05@yahoo.com to get alerts of my new posts

BBpin:7FF79963

Connect with me on Whatsapp: 2348134820569 and Join our Forex group ( Forex sniper)

Friday, October 3, 2014

A new look at Cadchf

Before I start,please take time to read my last post on this pair (click here).

Price broke the triangle I talked about and went back immediately giving me no real chance of buying.

The congestion is not looking over yet as we have price moving up and down to form a larger triangle.

As price adds up to itself, we ask ourselves, are we still in line?. Being able to follow price and allowing it to connect with us is very important. That's why I chose elliot waves analysis as my primary tool.

With what price came up with of recent, it shows clearly that the first corrective wave ( wave 2) of wave 5 of the impulsive moves ( in blue) is about to be completed as a triangle corrective pattern.

If this is anything to go by, we expect the price to break the upper line of the triangle for an explosive move upside. I will wait for a chance to buy at the break to target 0.8810.

Conversely, if price breaks the triangle downwards, what we will be having is a complex correction or temporary change in trend which requires more studies and patience.

Either way, price determines where it goes and we just have to understand him and follow. We should see a real action next week.

Connect with me on whatsapp: 2348134820569

Facebook: Sanmi Adeagbo

Twitter: @Forexelyte

BB Pin: 7FF79963

Let me also add you to my mailing list to alert you of my new post... E-mail: forexmaster05@yahoo.com

Thursday, October 2, 2014

Will Gold hit 1000 before the year runs out ?

In recent weeks, Gold has been trending down rapidly breaking barriers along the way. Will this dip continue? Well it's just a matter of time.

Going by the weekly chart,price broke out of a triangle in high momentum after 14 months of formation. This triangle marked the successful completion of wave 4 .

Price is running down to complete this impulsive move which could end at 1000 ( the next support) before the year runs out

The intra day (H4) chart is not contradicting the bearish move. The bearish move that happened immediately after the triangle formation has successfully completed three waves.

Presently, it's enclaved in the triangle of its own which will be completed at the successful break of the lower boundary of the triangle.

In the other way, price might break the upper boundary of the H4 triangle to test the resistance at 1240 thereby forming a zigzag corrective pattern instead of the current triangle before resuming the bearish move.