Treat as URGENT!!!!!!!

Registration Ongoing

Hello guys,

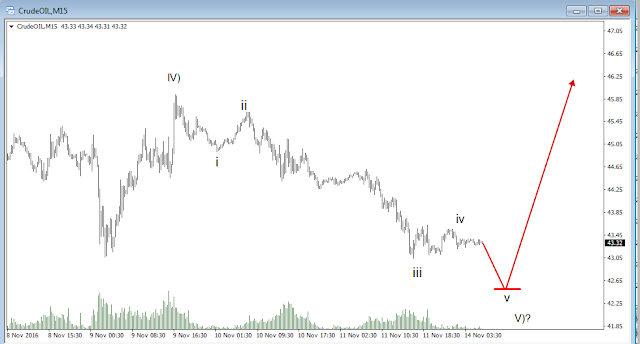

Many of you know me as an Elliott wave guy..right?. Little did you know that I also trade other patterns. A quick look at the price patterns I trade.

1. Impulse wave pattern (Elliott wave)

2. Diagonal patterns (Elliott wave)

3. Zigzag patterns (Elliott wave)

4. Triangles (Elliott wave pattern)

5. Head and shoulder pattern (Classical chart pattern)

Why did I add the head and shoulder pattern among many classic chart patterns).... The reason is that I have discovered a special way of using it with tools like Ichimoku Kinko Hyo and MACD. This is different from the normal traditional way.

I made this discovery because it was necessary for me. I love the H$S but it lagging nature puts me off. I needed to enter early. Any system that doesn't have a potential of 70% wins on 1:2 R/R is a NO for me. My human error can then reduce this to 60%. This is sustainable over a long term of trades with proper risk management- so I thought.

According to my personal research, the classic H$S doesn't fit into this. It lags as price would have moved very well after the breakout. There is need for a system that identifies and trade it before the breakout.

This strategy of spotting the H$S pattern fulfill my expectation perfectly.

Why I like this system

1. Can give a 70% wins on 1:2 R/R

2. Works on any market.

3. Appears rarely. On a hourly chart, can appear 5 times a year or less. Appears more often on lower time frame.

4. Can be used on any time frame.

5. It's very simple. A newbie trader can use it.

6. It works better than most of the systems out there.

7. It's systematic and definitive with structural rules to follow.

I will like to share this to empower 100 traders. Just 100. After that, it may go premium i.e you have to pay for it. So take the advantage now.

The webinar holds tomorrow.

Saturday: 17th December 2016 Time: 0800 GMT or 0900 WAT.

Link for registration: https://www.bigmarker.com/sanmi-adeagbo/Head-and-Shoulder-FOREX-meeting-with-Sanmi?show_live_page=true

There is still space for 94 attendees.

Registration Ongoing

Hello guys,

Many of you know me as an Elliott wave guy..right?. Little did you know that I also trade other patterns. A quick look at the price patterns I trade.

1. Impulse wave pattern (Elliott wave)

2. Diagonal patterns (Elliott wave)

3. Zigzag patterns (Elliott wave)

4. Triangles (Elliott wave pattern)

5. Head and shoulder pattern (Classical chart pattern)

Why did I add the head and shoulder pattern among many classic chart patterns).... The reason is that I have discovered a special way of using it with tools like Ichimoku Kinko Hyo and MACD. This is different from the normal traditional way.

I made this discovery because it was necessary for me. I love the H$S but it lagging nature puts me off. I needed to enter early. Any system that doesn't have a potential of 70% wins on 1:2 R/R is a NO for me. My human error can then reduce this to 60%. This is sustainable over a long term of trades with proper risk management- so I thought.

According to my personal research, the classic H$S doesn't fit into this. It lags as price would have moved very well after the breakout. There is need for a system that identifies and trade it before the breakout.

This strategy of spotting the H$S pattern fulfill my expectation perfectly.

Why I like this system

1. Can give a 70% wins on 1:2 R/R

2. Works on any market.

3. Appears rarely. On a hourly chart, can appear 5 times a year or less. Appears more often on lower time frame.

4. Can be used on any time frame.

5. It's very simple. A newbie trader can use it.

6. It works better than most of the systems out there.

7. It's systematic and definitive with structural rules to follow.

I will like to share this to empower 100 traders. Just 100. After that, it may go premium i.e you have to pay for it. So take the advantage now.

The webinar holds tomorrow.

Saturday: 17th December 2016 Time: 0800 GMT or 0900 WAT.

Link for registration: https://www.bigmarker.com/sanmi-adeagbo/Head-and-Shoulder-FOREX-meeting-with-Sanmi?show_live_page=true

There is still space for 94 attendees.